Market regulator Securities and Exchange Board of India (SEBI) on Thursday, 2 March, came down heavily on YouTube channel creators for manipulating stocks of listed companies by engaging in "pump and dump" schemes.

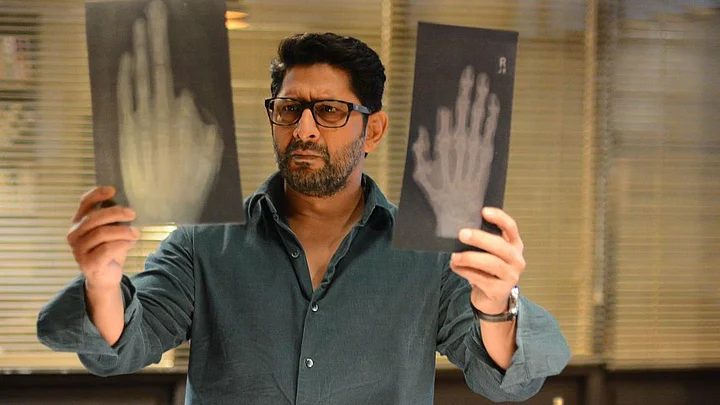

The regulator, through two separate orders barred 55 entities, including actors Arshad Warsi and his wife Maria Goretti, from the securities market for alleged price manipulation through YouTube, and subsequently, offloading the inflated shares of Sadhna Broadcast and Sharpline Broadcast.

SEBI has also impounded illegal gains to the tune of Rs 41.85 crore made by the entities after the alleged scam, ordering all 31 individuals to open an escrow account with a scheduled commercial bank and deposit the impounded amount within 15 days.

So, what is a pump and dump scheme? And what has the actor said about it? Read on.

Explained: Why Has SEBI Barred Actor Arshad Warsi & His Wife From Stock Market?

1. What is a Pump and Dump Scheme?

A pump and dump is a manipulative tactic in which a person tries to increase the price of a share using fake information. The claims made by the person are false, misleading, exaggerated, and spread to make personal gains.

A pump and scheme involves a three-step process:

First, a person buys a significant holding in a stock.

Next, they make exaggerated claims about the firm, encouraging people to "pump" their money into it and purchase more.

Last, as the stock price goes up, they "dump" it and pocket the gains. However, as the significant stock volume is dumped, its price falls, and other investors lose money

Fake information is usually propagated via social media platforms or emails. Unsuspecting small investors are schemed into investing in small and mid-cap stocks using banners and social media messages.

In this case, the fake information was being spread using YouTube videos on two channels – The Advisor and Moneywise.

The person spreading fake information is called a misleading message disseminator – or MMD. SEBI has termed such schemes as fraudulent and unfair trade practices, which can hamper the sanctity of Indian capital markets.

Expand2. What Has SEBI Said in Its Order?

SEBI, in its order, said that it received complaints, which alleged that “there was price manipulation and offloading of shares by certain entities in the scrip of television channel Sadhna Broadcast.”

The complainants claimed that misleading YouTube videos with false information about the company were uploaded to woo investors. These YouTube videos spread false and misleading news to recommend that investors should buy the Sadhna stock for extraordinary profits.

SEBI noted that these YouTube channels had lakhs of subscribers and the YouTube videos had crores of viewership aided by promotion through paid advertising campaigns.

The regulator also observed that the videos contained false statements about the growth story and future prospects of the company.

Subsequently, the misleading YouTube videos ceased to be available for public viewing, it added.

The regulator also alleged that the two YouTube channels The Advisor and Moneywise uploaded videos on Sadhna in July 2022. In the case of Sharpline, Midcapcalls and ProfitYatra had uploaded videos in May 2022.

Subsequent to the release of the YouTube videos, there was an increase in the price and trading volume of the Sadhna shares, as per SEBI.

The volumes appear to have been contributed by large number of retail investors likely influenced by the misleading YouTube videos, it said.

The Indian Express recently reported, citing sources, that Sadhna Broadcast is going to be taken over by the Adani Group as well as that the company will soon move from TV production to movie production, with a big American corporation entering into a contract worth Rs 1,100 crore to produce four devotional movies under the label.

Expand3. What is the Actor's Role in It?

The market has classified these 31 entities into categories as:

The creator of the YouTube channels as net sellers NSs/promoters and profit makers i.e. people who held shares of Sadhna at the start of the examination period and who traded in and net sold shares during the said period

Volume creators (VCs), i.e. people, outside of those classified as NSs, who both bought and sold shares of Sadhna during the said period

Information carriers (ICs)

Arshad Warsi and his wife have been categorised under VCs, who both bought and sold shares of Sadhna during the examination period.

In the case of Sadhna Broadcast, the regulator said that the actor made a profit of Rs 29.43 lakh, while his wife made gains of Rs 37.56 lakh.

"Prima facie, across the MMDs, NSs and VCs, the noticees have collectively helped create trading volumes and interest in the scrip, spread false and misleading YouTube videos, and hence induced unsuspecting investors to buy the Sharpline scrip at elevated prices, thereby prima facie violating the provisions of the SEBI Act and PFUTP Regulations. Collectively, the NSs and some of the VCs have booked extraordinary profits as a result of this scheme," the order read.

Expand4. What Has the Actor Said?

The actor, on his part, has denied any wrongdoing. He took to Twitter and requested everyone not to believe in hearsay.

Clarifying his side of the story, the 54-year-old said that he and his wife "took advice and invested in Sharda, and like many other, lost all our hard earned money."

Expand

What is a Pump and Dump Scheme?

A pump and dump is a manipulative tactic in which a person tries to increase the price of a share using fake information. The claims made by the person are false, misleading, exaggerated, and spread to make personal gains.

A pump and scheme involves a three-step process:

First, a person buys a significant holding in a stock.

Next, they make exaggerated claims about the firm, encouraging people to "pump" their money into it and purchase more.

Last, as the stock price goes up, they "dump" it and pocket the gains. However, as the significant stock volume is dumped, its price falls, and other investors lose money

Fake information is usually propagated via social media platforms or emails. Unsuspecting small investors are schemed into investing in small and mid-cap stocks using banners and social media messages.

In this case, the fake information was being spread using YouTube videos on two channels – The Advisor and Moneywise.

The person spreading fake information is called a misleading message disseminator – or MMD. SEBI has termed such schemes as fraudulent and unfair trade practices, which can hamper the sanctity of Indian capital markets.

What Has SEBI Said in Its Order?

SEBI, in its order, said that it received complaints, which alleged that “there was price manipulation and offloading of shares by certain entities in the scrip of television channel Sadhna Broadcast.”

The complainants claimed that misleading YouTube videos with false information about the company were uploaded to woo investors. These YouTube videos spread false and misleading news to recommend that investors should buy the Sadhna stock for extraordinary profits.

SEBI noted that these YouTube channels had lakhs of subscribers and the YouTube videos had crores of viewership aided by promotion through paid advertising campaigns.

The regulator also observed that the videos contained false statements about the growth story and future prospects of the company.

Subsequently, the misleading YouTube videos ceased to be available for public viewing, it added.

The regulator also alleged that the two YouTube channels The Advisor and Moneywise uploaded videos on Sadhna in July 2022. In the case of Sharpline, Midcapcalls and ProfitYatra had uploaded videos in May 2022.

Subsequent to the release of the YouTube videos, there was an increase in the price and trading volume of the Sadhna shares, as per SEBI.

The volumes appear to have been contributed by large number of retail investors likely influenced by the misleading YouTube videos, it said.

The Indian Express recently reported, citing sources, that Sadhna Broadcast is going to be taken over by the Adani Group as well as that the company will soon move from TV production to movie production, with a big American corporation entering into a contract worth Rs 1,100 crore to produce four devotional movies under the label.

What is the Actor's Role in It?

The market has classified these 31 entities into categories as:

The creator of the YouTube channels as net sellers NSs/promoters and profit makers i.e. people who held shares of Sadhna at the start of the examination period and who traded in and net sold shares during the said period

Volume creators (VCs), i.e. people, outside of those classified as NSs, who both bought and sold shares of Sadhna during the said period

Information carriers (ICs)

Arshad Warsi and his wife have been categorised under VCs, who both bought and sold shares of Sadhna during the examination period.

In the case of Sadhna Broadcast, the regulator said that the actor made a profit of Rs 29.43 lakh, while his wife made gains of Rs 37.56 lakh.

"Prima facie, across the MMDs, NSs and VCs, the noticees have collectively helped create trading volumes and interest in the scrip, spread false and misleading YouTube videos, and hence induced unsuspecting investors to buy the Sharpline scrip at elevated prices, thereby prima facie violating the provisions of the SEBI Act and PFUTP Regulations. Collectively, the NSs and some of the VCs have booked extraordinary profits as a result of this scheme," the order read.

What Has the Actor Said?

The actor, on his part, has denied any wrongdoing. He took to Twitter and requested everyone not to believe in hearsay.

Clarifying his side of the story, the 54-year-old said that he and his wife "took advice and invested in Sharda, and like many other, lost all our hard earned money."