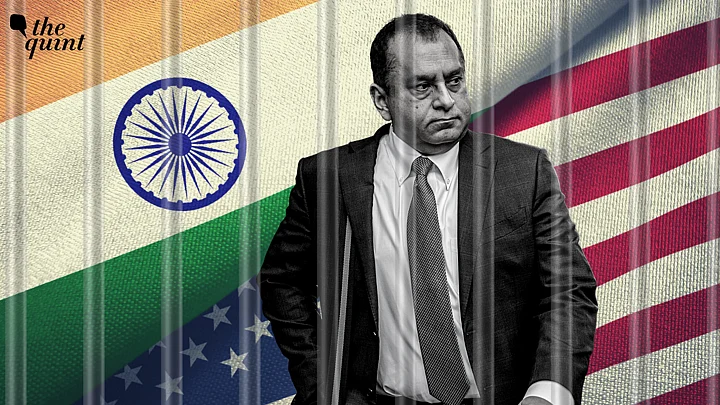

Indian American Ramesh “Sunny” Balwani, the former Chief Operating Officer of the defunct United States (US) startup Theranos, was sentenced to 13 years in prison for fraud on Thursday, 8 December.

The 57-year-old was associated with the start-up that claimed to sell revolutionary technology capable of running an array of blood and health tests with a single drop of blood through its machine.

Boyfriend to founder and CEO Elizabeth Holmes, who was once called “the female Steve Jobs,” Balwani’s story is one of caution in Silicon Valley after he contributed to risking patient health and defrauding investors as well.

"Patient health is the highest priority of our healthcare system, and Silicon Valley has long been home to healthcare start-ups that enhance the care of patients through technological developments," U.S. Attorney Stephanie Hinds said.

"Ramesh Balwani, in a desire to become a Silicon Valley titan, valued business success and personal wealth far more than patient safety. He chose deceit over candor with patients in need of medical care, and he treated his investors no better," she added.

John Carreyrou, The Wall Street Journal journalist who had exposed Theranos' scam, was reportedly told by an insider that Balwani was 'terrorising' employees and used to constantly surveil them through security cameras, according to a different Yahoo report.

The HBO documentary on Theranos titled The Inventor: Out for Blood in Silicon Valley showed him leading a chant of curses against Theranos' competitors and rivals.

But Balwani is only one of many Indian-Americans who’ve faced charges for committing fraud worth millions of dollars.

Here are some prominent desis accused of fraud-related crimes in the US.

Trivikram Reddy

In May 2021, Indian-American nurse practitioner Trivikram Reddy was sentenced to 20 years in prison and ordered to pay over $52 Million in restitution for his role in a healthcare fraud scheme in the US.

Reddy, 40, pleaded guilty to conspiracy to commit wire fraud in October 2020 and had been accused of engaging in a scheme to defraud Medicare and other private insurance providers, according to Acting US Attorney for the Northern District of Texas Prerak Shah.

Court documents revealed that the licensed nurse practitioner devised a scheme to defraud Medicare, Blur Cross Blue Shield of Texas, UnitedHealthcare, Humana, Aetna and Cigna by creating fraudulent patient bills.

Reddy created the bills by using the provider number of six physicians as treating doctors on the claims, even though they had no relation to the services.

After federal agents investigated one of Reddy’s medical clinics and found his staff manufacturing medical records in 2019, the Indian closed the clinic and terminated the business.

Prosecutors said Reddy created fraudulent patient bills by using the provider numbers of six physicians as the treating physicians on the claims, even though they did not perform the services.

After Reddy closed the clinic, he made the first of many wire transfers, that prosecutors say totalled to more than $55 million, all tied to fraudulent healthcare claims.

He pleaded guilty to wire fraud in October 2020.

Ameet Goyal

Indian American ophthalmologist (eye doctor) Ameet Goyal from New York’s Rye was sentenced to eight years in prison for a seven-year healthcare fraud scheme coupled with Covid-19 loan fraud.

The 58 year old billed millions of dollars of up-coded procedures, which are for more severe and expensive diagnoses or procedures than the actual diagnoses, and also fraudulently obtained two government-guaranteed loans, intended to help small businesses during the pandemic.

Goyal, 58, allegedly billed for millions of dollars of up-coded procedures, and fraudulently obtained two government-guaranteed loans intended to help small businesses during the COVID-19 pandemic.

US attorney for the Southern District of New York, Damian Williams, had said, “A prominent ophthalmologist and oculo-plastic surgeon who has now surrendered his medical license, Ameet Goyal was blinded by greed.”

“Over a seven-year period, he preyed on the trust placed in him and cheated patients and insurance companies of $3.6 million in false charges,” he added.

Williams also added that in an attempt to cover his tracks, Goyal created fictitious operative reports across hundreds of patient files and violated the integrity of the patients’ medical records, making it extremely hard for doctors to further treat them.

“Even after being arrested for this scheme, Goyal committed a breathtaking new fraud and stole $637,200 from the Paycheck Protection Program in the early days of a devastating pandemic,” Williams said.

Between 2010 and 2017, Goyal engaged in several counts of healthcare fraud, court documents said, by “up-coding” simple, cheaper surgeries and examinations as more complex, higher-playing operations in fraudulent bills sent to Medicare, private insurance firms and patients.

As a result of his fraud, Goyal received a minimum of $3.6 million in payments for procedures he had nothing to do with. He also pressured other employees within his practice to engaged in his fraud as well, threatening their livelihood if they didn’t comply.

Neil Chandran

50-year-old Indian-origin tech entrepreneur Neil Chandran was arrested in the US in July 2022 for his alleged involvement in an investment scheme that defrauded over 10,000 victims of more than $45 million, and also netted several luxury cars and real estate.

A resident of Las Vegas, Chandran owned a group of technology companies that he used in a scheme to defraud investors with false promises of extremely high returns.

He claimed that one or more of his companies were about to be bought out by a number of wealthy buyers.

His companies, which worked around several virtual-world technologies and also had their own cryptocurrency, made false and misleading representations to investors, under the garb huge returns after the companies were bought out.

However in reality, while there was no buyer group about to buy the company, a substantial portion of the funds Chandran received, was misappropriated for other business ventures and personal gain.

The charges against Chandran extend to three counts of wire fraud, and two counts of engaging in monetary transactions in the criminally derived property

If convicted, Chandran faces upto 20 years of imprisonment for each wire fraud charge and upto 10 years for each count of unlawful monetary transactions.

Arushobike Mitra and Garbita Mitra

Indian-Americans Arushobike Mitra and Garbita Mitra pleaded guilty to charges of conspiracy to commit fraud after the pair obtained $1.2 million in wire transfers from victims across the US.

The pair were a part of an international fraud where call centers based in India targeted US residents, especially the elderly, through computerised phone calls.

A US attorney said that after they contacted victims through automated phone calls, other members, also part of the scheme, would trick or coerce them into transferring large amounts of money physically or through wire transfers.

Impersonating government officials from the Social Security Administration, FBI, or DEA, the group threatened victims with vicious legal and financial consequences if they did not comply.

They further falsely made the victims believe that they were on call with a tech support company, coercing them into granting the caller access to their personal computers remotely.

Moreover the pair would also access the victims’ bank accounts, making it appear that they transferred money to the account, while simply moving funds from the account of another victim, inadvertently gaining their trust.

The caller would subsequently instruct the victims to “return” the money transferred to them through mail or wire transfer to other members, including the Mitras.

Arushobike and Garbita were charged with fraudulent transfer of cash from 48 victims across the with a total of over $1.2 million.

The pair now face a maximum penalty of 20 years and a fine of $250,000 or twice the amount of the loss, about $2.4 million.

Manish Singh

A court in the US sentenced Indian American Manish Singh to 40 months in prison for wire fraud and identity theft, connected to a fraudulent investment scheme worth almost $1.26 million.

The 48-year-old allegedly entered into an agreement with a married couple to create a business that would design and sell high-end fabrics in 2016. While the couple was to provide capital for the business, Singh’s contribution was using his apparent expertise and contacts within the fabric industry.

Singh, a resident of Maryland, claimed that the victim investor’s money was being used for several expenses related to the business, like manufacturing fabric in India.

“In reality, Singh was using the victims' money almost entirely for personal expenses, mostly to view live pornography online. Based on Singh's misrepresentations, the victims gave him approximately USD 1.26 million for the fraudulent joint business venture,” said the Department of Justice.