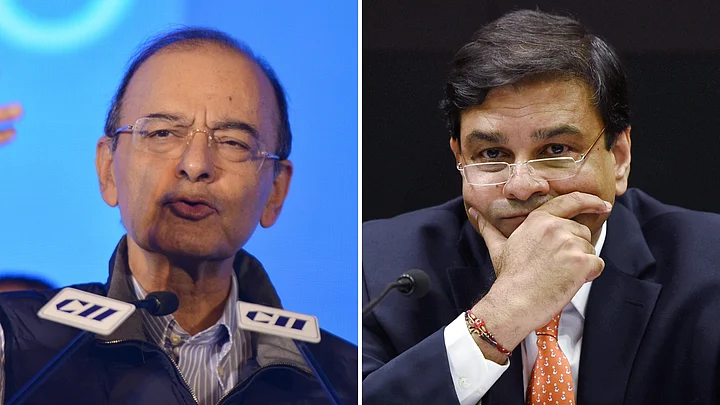

Former Reserve Bank of India (RBI) Governor Urjit Patel has said that the move to dilute insolvency laws caused differences between the RBI and the then Finance Minister Arun Jaitley.

According to an NDTV Profit report, the RBI had issued a circular back in 2018 which forced banks to classify the borrowers who were delaying payments as defaulters and this was the main reason for the clash.

The notice also did not let the founders of these defaulted companies to buy back their firms during insolvency auctions, and further pushing them into bankruptcy if the resolution timeline wasn't met.

In his book released on Friday, 24 July, Patel – who headed the RBI between September 2016 and December 2018 – said that the government seemed to have lost the enthusiasm for the legislation in the middle of the year.

“Instead of buttressing and future-proofing the gains thus far, an atmosphere to go easy on the pedal ensued,” he reportedly wrote, adding “Until then, for the most part, the finance minister and I were on the same page, with frequent conversations on enhancing the landmark legislation’s operational efficiency.”

Patel said that "there were requests for rolling back the February circular" and rumours were being spread suggesting that the circular may impact small businesses and they would suffer disproportionately.

These comments by Patel offer an insight into the rift between the government and the RBI which let to the Supreme Court of India taking down the February circular that left the Indian business society stunned.

This decision “made the insolvency regime vulnerable, possibly brittle," Patel reportedly wrote and suggested that subsequent changes like these risk the effort of cleaning up one of the biggest bad-loan piles in the world.

(With inputs from NDTV Profit.)

Urjit Patel’s successor, Shaktikanta Das, in 2019 eased some of the rules to allow defaulters to come up with a resolution plan within a period of180-days. He also lifted the deadline for the business to be pushed into bankruptcy.

According to a government report in March this year, the average time to resolve a case under the Bankruptcy Code is 400 days which was more than four years before the law was passed.

Mr Patel also said that periodic bailouts by the government and official entities will likely continue, at least for some banks.