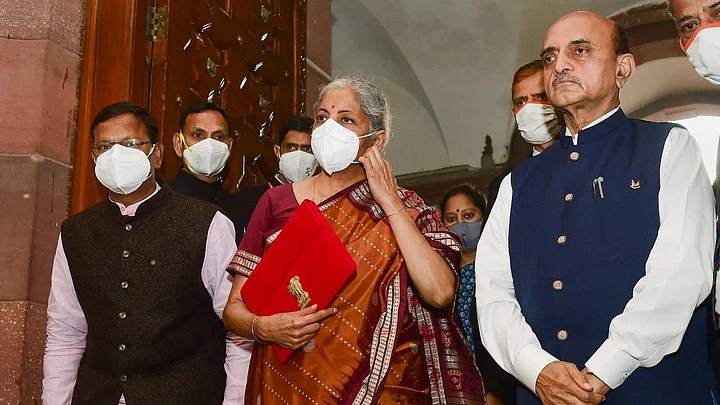

Presenting the Union Budget 2022 in the Lok Sabha on Tuesday, Finance Minister Nirmala Sitharaman announced that any income from the transfer of 'virtual digital assets' would be taxed at 30 percent.

What do these virtual digital assets include? What does this mean for those looking to invest in crypto? Here's a breakdown.

Which virtual assets will this apply to?

This tax regime will effectively apply to cryptocurrencies like Bitcoin, Ether and Dogecoin, and non-fungible tokens (NFTs).

Does this include the newly announced Digital Rupee?

This doesn't include the Digital Rupee that the RBI will issue.

I am a crypto investor. What should I know about new tax?

You won't be able to claim tax deductions on what you earn by selling virtual digital assets.

A 1 percent TDS (tax deducted at source) will be charged on payments made using digital assets, in order to keep track of transactions.

Any losses from selling virtual digital assets can only be set off against income from the sale of other such assets.

If I gift someone a virtual asset, do they have to pay tax?

If you gift someone a virtual digital asset, the recipient will have to pay taxes.

Does this mean crypto is legalised?

The Central government previously indicated that it wants to prohibit all private cryptocurrencies in India barring some exceptions. Now that it has officially taxed virtual digital assets, has the government essentially legalised crypto?

Not necessarily, because the Income Tax Act allows the government to collect taxes from illegal transactions as well. Only the cryptocurrency bill will provide clarity on this issue, and it is unlikely that it will be introduced in this session of Parliament.

Why did the government do this?

Apart from the extra tax revenue, the government is aiming to reduce the number of casual investors engaging in the crypto market without proper research or an understanding of the risks involved.

"The taxation on income from these assets is a fairly high percentage, and is matching the tax bracket imposed on forms of speculative income such as gambling and prize money," says Gautam Kathuria, "Losses from these transactions also cannot be offset against other sources of income from different financial instruments."

The RBI had earlier voiced "serious concerns" around private cryptocurrencies and the financial instability they might cause.

Some fear the heavy taxation will hurt India's ability to stand up to the global competition.

"Though the government has tried to curb peer-to-peer transfers of cryptocurrencies through higher taxation, which is understandable, it may be detrimental to web 3.0 startups and developers who have to compete globally," says Ankitt Gaur, CEO of EasyFi Network.

"I believe, regulatory bodies need to be formed and given autonomy here to understand and regulate as per the complexity of the industry on an ongoing basis," he adds.