A message, which has gone viral in the past, is being reshared to claim that 'only Hindu temples have to pay taxes while other religions enjoy freedom'.

However, we found that the claim was false and taxation in India is not done on the basis of religion. The Ministry of Finance, too, had clarified the same in a press release in 2017.

CLAIM

A Twitter user called Elvish Yadav, who has a verified account with close to 1,50,000 followers, posted a tweet that said, "In a country where everyone enjoys religious freedom, why only Hindu temples have to pay taxes? #FreeTemples"

Similar claims were shared by several users on Facebook and Twitter, archives of which can be found here, here, and here.

We also found that such claims were made by people earlier in 2017 when the Goods and Services Tax (GST) was introduced. BJP leader Subramanian Swamy had also claimed that only temple activities will be taxed and not mosques or churches.

WHAT WE FOUND OUT

According to the Central Goods and Services Tax (CGST) Act, any business/entity has to register themselves under Goods and Services Tax, if their aggregate turnover in a financial year exceeds Rs 40 lakhs (in all normal category states, except Telangana) and Rs 20 lakhs (in special category states, except J&K and Assam).

There is no separate tax for an entity/body belonging to particular religion.

According to the information given on the website of Central Board of Indirect Taxes and Customs (CBIC), 'all services provided by charitable and religious trusts are not exempt from GST'. A few of them are:

Services of transportation of passengers for a pilgrimage

Events, functions, celebrations

Shows against admission fee or tickets

Some activities which are exempt include:

Conduct of religious ceremony

Renting of precincts of a religious place meant for general public

However, it must be noted that the 'renting' should not apply to 'renting of rooms where charges are Rs 1000 or more per day', 'renting of shops for business and other commercial activities' and even 'renting of halls, space for Rs 10,000 or more per day.'

The website further adds that the exemption is for religious activities of all religions.

IN SIMPLER WORDS...

Religious places are often managed by trusts, which also own other properties. Any income earned from renting out the property for functions or sale of products other uses will be taxable. So, exemptions and taxation is across religions and not just on temples.

To get the exemptions, the trust needs to be registered under Section 12AA of Income-tax Act, 1961 and the "services provided by Trusts are falling within the meaning charitable activities."

FINANCE MINISTRY HAD CLARIFIED THIS IN 2017

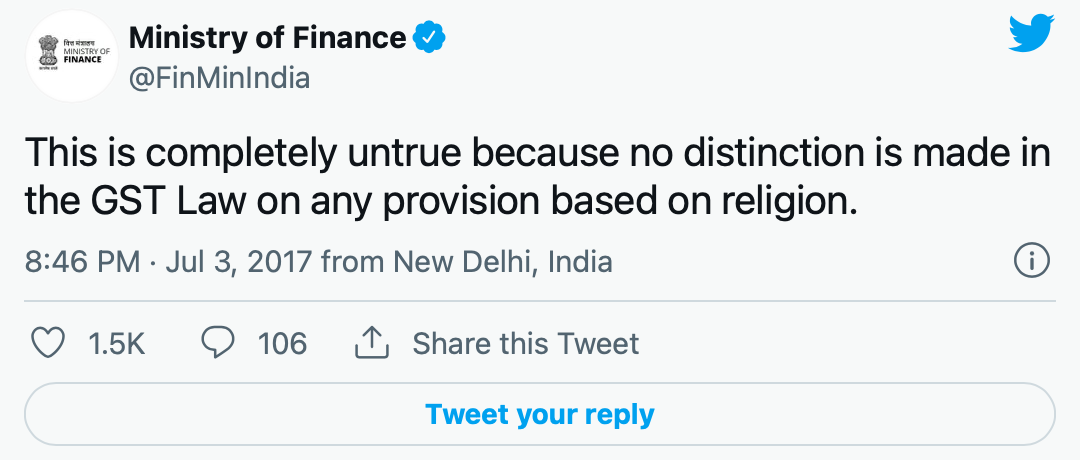

The Ministry of Finance had issued a clarification on the same matter in 2017.

"There are some messages going around in the social media stating that the temple trusts have to pay the GST while the churches and mosques are exempt. This is completely untrue because no distinction is made in the GST law on any provision based on religion," the press release said.

The MoF also posted the same on their official Twitter handle. (Note: Swipe right to see the next screenshot)

Clearly, an old and a false message claiming that only temples have to pay taxes is circulating once again. But the message isn't true!

(Not convinced of a post or information you came across online and want it verified? Send us the details on WhatsApp at 9643651818, or e-mail it to us at webqoof@thequint.com and we'll fact-check it for you. You can also read all our fact-checked stories here.)