WhatsApp payment feature is now live in India, making it the first country to support in-app payment on the popular messaging platform. The payment option has made its way to all WhatsApp users as the NPCI (National Payments Corporation of India) has given a green flag for the payments feature to be used here.

The payment feature is enabled merely by linking the app to the country’s Unified Payment Interface (UPI) that allows users to link their bank account without sharing confidential details.

The Facebook-owned messaging app has also conveyed this in the terms and conditions section, which does not hold WhatsApp liable for any payment mishaps.

We managed to activate the feature on our phone, and here’s how it works:

How to Use the Payment Feature on WhatsApp

- Check if your phone has the latest version of WhatsApp (2.20.206.5)

- Go to Settings and select Payment

- Verify your mobile number to link with bank account

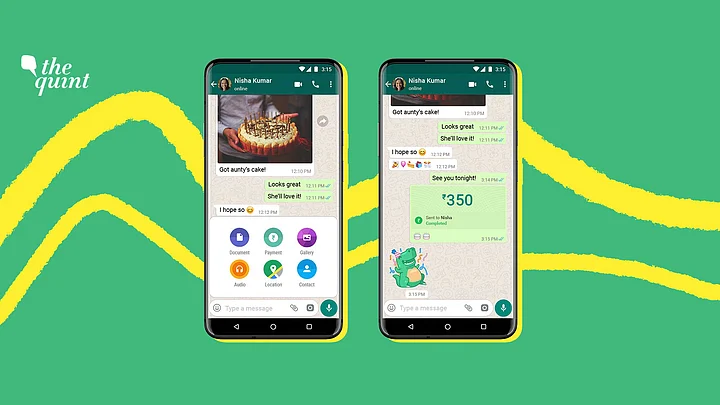

- After linking your account, head over to the chat window

- Pay another user from the message interface with a 4-digit PIN as the password

The feature is likely to reach all users in the coming weeks, but from what we have experienced, the UPI-integration does seem to work as advertised.

As you can see here, linking the payment feature works out in a user-friendly manner, and all you need is a bank account which is linked to your mobile number. With UPI, WhatsApp has now become capable of letting you transfer money between different bank accounts (no mention of e-wallet money transfer, yet).

Also Read: WhatsApp Keen to Unite With UPI for Digital Payments in India

WhatsApp is not a licensed financial institution, do not receive, transfer, or store any funds in connection with Payments, and are not responsible for UPI service interruptions or acts or omissions of PSPs or your bank including the payment, settlement, and clearance of funds. You have a separate relationship with your bank regarding your bank account, and WhatsApp has no affiliation with your bank in this respect.WhatsApp Payment terms and conditions

To use Payment on WhatsApp both the sender and receiver need to activate UPI on their phones.

All users will have to accept the Terms of Payment feature to activate the service. Also, if anyone just wants to receive the money, they’ll also have to activate the feature on their device.

Once you select the bank to link, open the chat window and you’ll see the Payment option showing up alongside Gallery, Location and more.

You’ll get a notification from the bank about the transaction which took place, and in a few minutes, your chat window on WhatsApp will also indicate the same.

As of now, the new feature is not available while using the app through WhatsApp Web.

With WhatsApp’s more than 200 million active user base in the country, UPI is likely to surpass Paytm. And with WhatsApp messages already encrypted, payments are likely to get adequate security.

While the National Payment Corporation of India (NPCI), the makers of UPI have been boasting about its transactional growth over the past few months, WhatsApp could actually be the trump card that unlocks the true reach of the digital payment system.