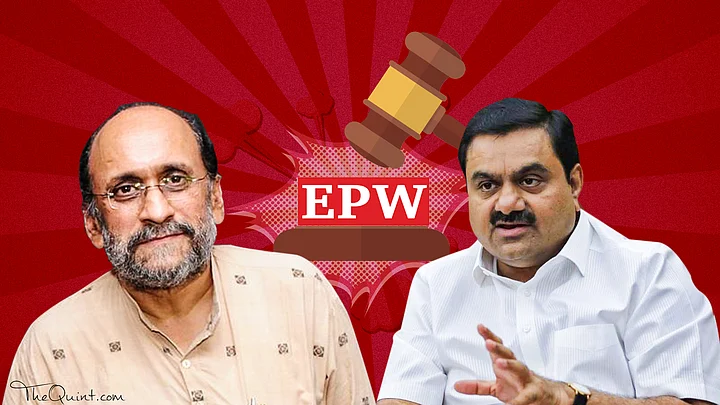

- Resignation of EPW editor Paranjoy Guha Thakurta after his article about Adani Power Ltd was withdrawn, is being viewed as EPW succumbing to corporate pressure.

- However, a detailed investigation into the article by The Quint’s Legal Correspondent raises questions about the allegations and conclusions reached in it, which suggests that the Trust withdrew it for failing to meet editorial standards.

- These failings in the article (listed below) mean that Adani Power Ltd appears to have grounds to sue for defamation.

- The headline allegation in the article is based on a single statement from Mr Guha Thakurta’s confidential source, and the circumstantial evidence used to corroborate this does not appear to add up.

- The article also makes two misleading arguments about changes to customs duties over the years, and Adani Power Ltd’s submissions before the Gujarat High Court, that are based on an incorrect understanding of facts and law.

- The Trust have justifiably held that that Mr Guha Thakurta may have committed a grave impropriety by unilaterally responding to Adani Power Ltd’s defamation notice regarding the article.

- It is important for journalists taking on corporations to get their facts absolutely right, as failure to do so will make it even tougher to speak truth to power.

Why did one of India’s most respected journals decide to retract an article written by their own editor, a man who is one of the most reputed investigative journalists in the country?

Too caught up to read? Listen to the story:

Did the owners of the journal, a Trust whose members include some of India’s most esteemed scholars, succumb to pressure exerted by a powerful corporate group that wanted to protect its interests?

Was the editor forced into a position where he had to resign because he stood up to a company viewed as close to the government of the country?

These are not the questions I thought I would be answering when I started to write this article. I was merely supposed to be analysing whether a defamation notice, sent to the owners, editor and authors of Economic and Political Weekly (EPW) by the lawyers for Adani Power Ltd, had any substance to it.

However, over the course of my investigation, these questions became indelibly linked with any analysis of the notice. On 18 July 2017, Paranjoy Guha Thakurta resigned from his post as editor of EPW. The Sameeksha Trust, which owns and publishes EPW, withdrew the article that was the subject of the notice.

The issue has escalated into one of standing up to intimidation of the press by a corporation. The Wire has defiantly kept the article on its website, despite receiving the same defamation notice from Adani Power Ltd. 155 scholars wrote an open letter to the Trust expressing dismay over the events.

But the more I looked into this article, the arguments it makes, and the basis for making these arguments, the more a different story began to emerge. One where a reputed journal had published an article co-authored by its fearless (some would even call maverick) editor, which made claims that didn’t add up. Where the editor decided he could act on behalf of the Trust, disregarding procedure. Where the Trust realised that the article didn’t seem to adhere to the required standard of rigorous evidence, and so asked for this to be withdrawn. Where the Trust also realised its editor may have needed to be reined in. And where a corporate group which I do not claim is pure as driven snow, actually turned out to have some reasons to be upset.

But don’t take my word for it.

The Easy Interpretation

It is easy, perhaps, to agree with the prevalent dismay and to view these events as a successful example of a SLAPP, or ‘strategic lawsuit against public participation’. Social media has, predictably, been awash with such reactions, and not just from those viewed as left liberals.

Mr Guha Thakurta has also not gone gently into that good night, claiming that the Trust’s statement about why he resigned was incomplete, releasing his own statement about why he had resigned, and giving a long interview to The Wire in which he claimed that he was forced to withdraw the article.

As most senior journalists will admit, it is hardly out of the ordinary for a company to send legal notices over articles that are critical of them. Most of these notices are nothing more than hyperbole, making grand claims of wrongdoing meant to scare recipients into folding.

To a large extent, the defamation notice from Adani Power Ltd’s lawyers, sent on 5 July 2017, reads like any one of these. In today’s climate, with numerous concerns about the freedom of the press, it looked like this was another case of corporate intimidation by the Adani company.

But when I went back to the article and started looking at things they had taken exception to, I realised that deciding who was right and who was wrong was not so easy. After spending several days researching the arguments, trying to corroborate them, and speaking to Mr Guha Thakurta, I realised that the easy interpretation did not necessarily stand up to a more rigorous assessment.

Why Is Adani Power Limited Saying the EPW Article Is Defamatory?

EPW spent over four months looking into perceived irregularities in the dealings of the Adani group of companies. These resulted in a couple of articles in 2016, and two articles co-authored this year by Mr Guha Thakurta. The spark beneath this particular fire was an article published on 17 June 2017 titled ‘Modi Government’s Rs 500-Crore Bonanza to the Adani Group’ (now only available on The Wire).

Adani Power Ltd (APL), in its notice dated 5 July, has alleged that several statements in the article are defamatory. These statements broadly relate to two arguments made by the authors.

1. SEZ Rules tweaked as a special favour

Mr Guha Thakurta and his three co-authors have argued that the Central Government has:

quietly tweaked rules relating to special economic zones – and the new rules specifically favour the Adani Group.

This allegation revolves around a 2016 amendment to the SEZ Rules 2006, which made it possible for customs and excise authorities to process applications for refunds of customs duties. A confidential source told Mr Guha Thakurta that this amendment was inserted to make it easier for Adani Power Limited (APL) to claim a refund of Rs 506 crore relating to their Mundra Power Plant.

The authors have at the start mentioned that this is a decision by the government, not APL or any other Adani company. However, they also state that Gautam Adani is understood to be close to the Prime Minister, and then ask at the end of the article:

“Were these rules tweaked to help one company headed by a well-connected individual?”

Although these statements do not allege any wrongdoing on the part of APL per se, such statements impute collusion between the government and APL. A statement is defamatory if it harms the reputation of a person, whether explicitly or by imputation. It is not, therefore, difficult to see why APL views this argument by the authors to be defamatory.

2. APL is claiming refunds on duties it never paid in the first place

The second allegation by the authors is a more direct one. They argue that APL’s refund claim is based on a falsehood. According to them, the refund is being claimed on customs duties paid by APL on raw materials and consumables used as inputs at the Mundra Power Plant. However, their confidential source says that APL never paid any such duties on inputs, which amount to Rs 1,000 crore (as of March 2015).

The article casts some serious aspersions on APL in relation to this issue. According to their source, the Gujarat High Court in 2015 was ‘misled’ by APL’s claims to have paid duties on raw materials even though they had not paid any such duties. In that case, APL was challenging the validity of a 2010 customs notification that imposed duties on the supply of electricity outside an SEZ on the basis, among other things, that this would amount to double taxation.

According to the authors, the “fact of payment of duty on coal has been submitted by APL to the Gujarat high court.” They then raise concerns that the Gujarat High Court judgment, which ruled in APL’s favour, did not cite any evidence that duties were paid by APL. Further doubts are raised about how the additional solicitor general representing the Union of India in that case did not object to any of this.

In a nutshell, therefore, the article alleges that APL has claimed a refund of duties it never paid in the first place. It does not take much imagination to see why APL views this statement as defamatory. To have made such a refund application, and to have made such a claim in court, without having paid any duty in the first place, would indicate fraud and perjury on behalf of APL, which would obviously negatively affect its reputation.

Does This Justify the Defamation Notice?

Of course, just because APL may consider these statements to be defamatory, does not mean they would succeed in a defamation case before the courts. It is important to note that they have not, in fact, filed any actual case in court, whether for civil or criminal defamation. The notice sent to Sameeksha Trust and the authors is strongly worded, and runs into 34 paragraphs, but most of it is fairly standard legal hyperbole that has no real significance.

However, this does not mean that the article did not include defamatory statements. Notwithstanding the overblown and extremely intimidating language of the notice, drafted by Ahmedabad advocates Thaker & Co, it does raise some valid concerns about the article.

The article generally quotes confidential sources when making the most serious allegations, which is a sensible thing to do, but this does not protect the authors entirely. The introduction and the statements following these quotes endorse the substance of the allegations, which means they cannot get away by saying they are merely reporting someone else’s words.

Truth Is a Complete Defence, Except When it Isn’t

I spoke to Mr Guha Thakurta briefly on the day of his resignation, and in great detail on 27 July 2017, to discuss my concerns with the article’s content. Mr Guha Thakurta was firmly of the opinion that his article spoke the truth, and that this was a complete defence to any allegations of defamation.

If you are able to show that a defamatory statement is true, this can be used as a defence to a claim of defamation, to varying degrees of success. In a civil defamation case, truth is a complete defence, which means that if your statement is true, it doesn’t matter if it ends up damaging someone’s reputation. In a criminal defamation case, truth needs to be paired with public good – if you publish a true statement but its publication serves no public interest, you will have committed criminal defamation if your statement harms someone’s reputation.

If APL took this to court then, the Sameeksha Trust (as the owners of EPW), and the authors of the article would have to show that the allegations in the article are substantiated, and that making these allegations in the article was in the public interest. They could also try to argue that the article is a fair opinion/comment on known facts.

Unfortunately, in my opinion, the article’s foundations are far from stable, offering little proof of its allegations, and drawing unsubstantiated conclusions from events and facts which have no connection.

Were the Rules Actually Tweaked to Favour Adani?

A senior official of the Adani Port and SEZ (whose identity is not revealed) is the source of the allegation that the SEZ Rules were tweaked to facilitate APL’s refund claim. But that’s it. No basis on which the official says so, no documents, nothing. The title of the article, the sub-title, the opening paragraphs, all hinge on this allegation, and yet there is absolutely nothing to corroborate this one statement.

Corroboration can of course also be circumstantial. If the authors were able to show that, having regard to all relevant circumstances, the amendment was brought in to make a special case for the Adanis, there would be no real issue. Unfortunately, nothing in the article really bears that out, as I will discuss in this and the following sections. The first place to start is with the amendment itself, which introduces the following rule 47(5):

It is not as though this amendment only applies to the Adanis, or is detrimental to the government or the public in any way. On any objective analysis, this amendment benefits anyone operating in an SEZ wishing to claim a refund of duties paid.

The Rules as they earlier stood did not specify any forum for appeals, refunds or any sort of disagreement with assessments of customs duties relating to SEZs. Still, refunds on excess duty or wrongly paid duty were always open to claim under s. 27 of the Customs Act 1962, regardless of whether the entity claiming the refund was based in an SEZ or not.

A clarification on the appropriate forum to do so, which is all the amendment is, does not create an entitlement to refunds, or any special rights for the Adanis. This means that certain statements in the article, unless justified with some very strong evidence and reasoning, become intentionally misleading, such as this one:

It appears at face value that by amending the SEZ Rules to insert a provision for companies to claim refunds on customs duty, the department of commerce is allowing APL to claim refunds on duty that has never been paid by it in the first place.(emphasis added)

Of course, despite benefitting others, if the amendment was brought with the intention of helping APL, there is a story to tell there. But the text of the amendment, and the effect it will have, do not in themselves betray any such favouritism, and nor can a comment from an insider without specifying why the insider thought this was the case.

Mr Guha Thakurta argues that it is not the amendment in isolation, but the whole chain of events leading up to it, including the refund claim by APL, the various changes in customs rules for eight years previously, and the case before the Gujarat High Court, when taken together, that indicate dubious intent on the government’s behalf. So I looked at the rest of the events to see if they are accurate and in any way justify the headline claim.

Did APL Really Fail to Pay Duties on Consumables and Raw Materials?

This allegation in the article also relies exclusively on information received from a confidential source. However, at least here, the authors claim that they have documents which were leaked to EPW, that “clearly indicate that APL had not, in fact, paid the duty on raw materials and consumables”.

This allegation of failure to pay such duties is explosive, and is what the entire article should have been about, provided the documents are credible. There is a great story to tell here, especially given the silence of the government departments when asked about whether APL had paid the relevant customs duties, and APL’s failure to expressly address this in their response to the authors’ questionnaires. Mr Guha Thakurta also points out that his investigations have shown that even though the refund applications were processed by the authorities, no actual payments were then made to APL. Which again, raises some serious questions, and I cannot stress how important it is that we find out the truth of this.

According to the article, the documents say that:

there has been no tax paid on raw materials and other consumables, which is mandatory as per the SEZ law.

That such taxes are mandatory in law is only partially correct. Under Rule 47(3) of the SEZ Rules 2006, a producer of electricity located in an SEZ which transfers electricity generated in the SEZ outside of the SEZ to Indian territory (known as the Domestic Tariff Area or DTA), has to pay duty on consumables or raw materials, to the extent these were used in producing the electricity transferred out of the SEZ. If no electricity is transferred out of the SEZ, no duty needs to be paid on the consumables or raw materials used to generate electricity at the power plant.

What this means is that a power plant like APL’s would not pay any duties on things like coal when they were brought into the SEZ, claiming a duty exemption under the SEZ Rules. They would only pay duty on inputs like coal to the extent that such coal was used to generate electricity going out of the SEZ. According to the article, APL had availed of duty exemptions to the tune of Rs 1000 crore. It should be noted that mega power plants (such as APL’s in this case) located outside SEZs also don’t pay duty on items like coal, under the Electricity Act 2003.

The point of bringing this up is that even if APL claimed duty exemptions on inputs of up to Rs 1000 crore, they wouldn’t necessarily have to pay all of that when transferring electricity out of the SEZ. They would only be liable to pay duty on the inputs to the extent used to produce the amount of electricity that was transferred outside the SEZ.

Regardless of this, we have no reason to disbelieve Mr Guha Thakurta’s assertion that the duties on raw materials and consumables were not paid, and that he has documents that establish this. If he can prove this, the statement is not defamatory.

Unfortunately, the article goes further than just alleging this non-payment, and the additional arguments on this issue appear to be wrong in fact and law, and are therefore misleading.

Misleading Argument 1: Listing Customs Notifications That Were Irrelevant

Till now, I have only touched on customs duties payable on raw materials or consumables. This is because according to the article and Mr Guha Thakurta during our meeting, APL’s refund claim of Rs 506 crore related to duties on raw materials and consumables. For the sake of convenience, let us call these ‘duties on inputs’.

However, customs duties are not only levied on inputs, they are also levied on the goods produced and sold (in this case: electricity), or in other words, ‘duties on outputs’. A huge problem with the article is that it confuses and conflates the two.

Take for instance this paragraph:

According to this paragraph, after February 2010, the scheme for payment of duties on inputs changed. If we take this paragraph to be true, while earlier duty needed to be paid on such inputs used to generate electricity, after February 2010, a number of changes were made, initially charging 16% duty, then 3 paise per unit.

The next paragraph then mentions that a subsequent notification removed duty altogether for power plants in SEZs with installed capacities greater than 1000 MW each, approved before 27 February 2009, which seems designed to benefit companies like APL. Given the fact that they subsequently put in a refund claim, Mr Guha Thakurta believes these events are connected, and that seems, at first glance, fairly persuasive.

The problem is that all those notifications from 2008 to 2016 dealt with duties on outputs. The refund claim by APL, on the other hand, allegedly deals with inputs. There is thus no connection whatsoever between the two. And contrary to what’s said in the article, even since February 2010, power producing companies in an SEZ still have to pay duties on inputs used to generate electricity, under SEZ Rule 47(3). Hence there is no question of duties being “foregone”.

It is also important to note that most of the changes to the duties on outputs were brought in by the previous government. To include them as part of the chain of events that establish that the ‘Modi Government’ tweaked the rules for the Adanis, without mentioning the role of previous governments makes little sense, instead indicating a bigger problem with regulatory changes in the country.

I attempted at great length to explain the distinction between these duties on inputs and outputs to Mr Guha Thakurta, and thereby demonstrate why this argument would come across as misleading. Suffice to say, he did not agree with me, and yet failed to explain why, beyond saying this was his interpretation.

Misleading Argument 2: Arguing That the Gujarat High Court was Misled

The article also says that the Gujarat High Court wrongly decided the 2015 case on the basis of this false claim, which is, quite frankly, an inaccurate reading of the judgment. The issue before the Gujarat High Court was whether it was possible for the government to retrospectively charge any company customs duty on its supply of electricity out of an SEZ, that is, duties on outputs. The challenge to this based on double taxation centred on the fact that the company was already liable to pay customs duties on inputs under Rule 47(3) of the SEZ Rules.

It did not therefore matter whether APL had actually paid those duties or not – under Rule 47(3) they were still supposed to pay them. APL therefore did not need to submit evidence that they had paid duties, they just had to establish that Rule 47(3) applied to them. Yes, if APL had claimed in court that they had paid the duties, and if it were proved that they hadn’t, this would amount to perjury. However, this would still not relate to the issue in that case and would not affect the Gujarat High Court’s judgment.

More importantly, there is no record in the case that APL actually made such a claim. The High Court judgment when discussing APL’s arguments only mentions that they say they were liable to tax, not that they actually paid it. There is one throwaway line in the Court’s conclusion that references duties on inputs being paid, but this is as part of a hypothetical. As a result, this cannot be taken as proof that APL made such a claim.

Again, I put it to Mr Guha Thakurta that there was a distinction in law between liability to pay and actual payment. While he said I was free to nipick on the distinction, he didn’t think this was relevant or that this demonstrated a failing in his article.

Is This Why the Trust Decided to Withdraw the Article?

As mentioned above, the Trust is being castigated for having bowed to pressure from the Adani Group and so withdrawing the article. The trustees are also being accused of treating Mr Guha Thakurta unfairly. The Trust denied this in a statement dated 20 July 2017, stating that:

There is no question of the Sameeksha Trust, an independent non-partisan institution, bowing to external pressures of any kind. It never has. It is guided solely by the objectives of maintaining the ethos, quality and standards of EPW, while ensuring spotless propriety and ethics in the working of its staff.

Based on this statement and additional corroboration, it would appear that the Trust decided to withdraw the article because it did not meet EPW’s editorial standards. This is not surprising in light of the flaws uncovered in the analysis above, in particular the misleading arguments regarding notifications and the Gujarat High Court. The fact of the matter is that the EPW investigation discovered some interesting things which needed to be reported, but some of the conclusions Mr Guha Thakurta even now stands behind, were unsubstantiated.

The trustees of the Sameeksha Trust include outspoken intellectuals like Romila Thapar, Deepak Nayyar, DN Ghosh and Dipankar Gupta. These are hardly the kind of people that you would expect to succumb to strong-arm tactics by a big corporation, but even if one were to accept that this could happen, it would be remiss to accuse them of such a surrender when there are reasonable grounds to question the article.

At the very least, we should give the Trust a chance to fully explain the situation, and we understand that a statement addressing these questions will be released early next week.

It should be noted that even though the Trust may have been justified in not having confidence in the article, the manner in which was done was and is unsatisfactory. Mr Guha Thakurta explained that he was instructed to do this during a meeting with the Trust, and that he acceded to the Trust’s wishes and phoned someone to take it down.

However, the Trust should have released a statement about why they took the article down, what procedures were followed to do so, or something to this effect. This is what EPW has done previously when retracting articles for plagiarism. Instead, the relevant section of the website merely says that the page one is looking for cannot be found, which is not good form.

Was the Trust’s Treatment of Mr Guha Thakurta Unfair?

The Trust’s statement on 20 July 2017 said that Mr Guha Thakurta submitted his resignation to them after being informed that the Trust were of the view that he had committed a “grave impropriety”. This was not, however, about the content of the article, but instead Mr Guha Thakurta’s unilateral decision to send a response to APL’s defamation notice on 6 July 2017. Mr Guha Thakurta engaged a lawyer on his own and drafted a letter denying APL’s defamation accusations. Problematically, the letter claimed to be on behalf of the Trust, as well as all the other authors of the article. At no point did he ask for, or receive, the Trust’s approval to take such an action.

Mr Guha Thakurta responded to the Trust’s statement by saying that this did not tell the whole story. He claimed that in addition to upbraiding him for his unilateral response (which he termed a “procedural lapse”, and apologised for), the Trust also imposed conditions on him to continue that no self-respecting editor could accept. These included a withdrawal of the article, the appointment of a co-editor, the formulation of clear roles and duties for editors, and a prohibition for him to write any articles under his own byline.

This has only added to the narrative that Mr Guha Thakurta was forced out of his job for taking on powerful vested interests. But once again, a more sober reflection on the facts suggests a different conclusion.

Why sending the response on others’ behalf was wrong

Mr Guha Thakurta was entirely justified in wanting to respond to the defamation notice from APL. It alleged that he was acting with malice, and was making false statements, which no doubt rankled someone of his standing and reputation. However, he had no right to respond to the notice in the manner he did.

If the notice had been addressed to him alone, his actions would have been beyond reproach. However, the notice was addressed first and foremost to the Sameeksha Trust, and to the other authors as well. Again, if Mr Guha Thakurta had sent a response on his own behalf, there would have been nothing wrong in what he did.

But he claimed to be acting on the Trust’s behalf, without informing them, let alone getting their approval. He claimed to be acting on behalf of the other authors, without consulting them at all.

Legally speaking, this could even serve as grounds for claims of misrepresentation and maybe even fraud by the Trust and the other authors, if they felt that they had suffered some harm as a result. Luckily for Mr Guha Thakurta, no such claims are being prepared against him. The action remains gravely improper, however.

Why the response could have consequences for the Trust

Mr Guha Thakurta did apologise to the Trust, but he believes that his actions were justified since APL’s letter was a standard threatening letter, which editors respond to normally. He continues to argue that his actions did not create a danger of legal liability for the Trust since this was only a response to a notice.

However, as I discussed with him, his letter commits the Trust to certain positions regarding the veracity of the claims in his articles, which the Trust is unhappy about since they don’t have faith in the article. This could have perhaps been avoided if his letter had been stated to be Without Prejudice, but this is not the case, and so this letter could be admissible as evidence in any subsequent proceedings.

In light of the severity of his actions, the alleged conditions imposed by the Trust on Mr Guha Thakurta are hardly surprising. The Trust has not denied that these conditions were put in place. However, we understand that the Trust did not prohibit Mr Guha Thakurta from writing under his own byline, only encouraging him to be more circumspect, in accordance with the traditions of previous editors of EPW.

It should also be noted that reportedly, this was not the first instance of friction between Mr Guha Thakurta and the Trust, and, for that matter, other members of the editorial staff at EPW. An example of this can be read in this open letter from EPW staff to the Trust – we can confirm that this letter was indeed sent by EPW staff, though we cannot confirm or deny the veracity of its contents.

The imposition of conditions on Mr Guha Thakurta should therefore not be viewed in isolation, although, as argued above, this would also have been justified.

This Is Not an Apologia for Corporate Intimidation

This article might be viewed by some as a betrayal of the press, and support for attempts by a large corporate group to suppress reporting by independent journalists. It is not.

Neither is it an attack on the journalistic values of Mr Guha Thakurta or any of the authors at EPW. They uncovered certain facts that genuinely needed to be brought to light, and many of the problems I have raised relate to technical points that they, without legal training, would not have understood. They had successfully run other stories on the Adani Group which did not include such mistakes, including an article published on 14 January 2017, titled ‘Did Adani Group Evade ₹1,000 Crore Taxes?’.

The APL notice of 5 July mentioned this article as well as an example of the authors’ intent to malign the Adani Group, though they did not ask for this article to be removed in this notice.

There is no doubt that, as Mr Guha Thakurta mentioned, powerful corporate interests use their monetary power and influence to suppress reportage and commentary that portrays them in a poor light. This is used not only to prevent the publication of such coverage, but is also meant to have a chilling effect on other journalists, and allow the corporations to act with impunity.

In light of this, it is essential that investigative journalists with the experience and credibility of Mr Guha Thakurta do not allow such actions to stop them from doing the good work they do. This is especially important in a time when the government and its allied corporate interests seem to think that they are immune to criticism, and beyond scrutiny.

But it is also because of this that I have taken this stance. This is a difficult enough fight as it is, and we cannot afford to make mistakes that will only provide more ammunition to those who would muzzle the free press.

Mr Guha Thakurta claims that he has sufficient proof to back up his assertions in the article, but as my analysis shows, even if they are what they claim to be, there are numerous vulnerabilities in the allegations in the article. APL would merely need to point out a large number of these flaws, without them being fatal in themselves, to bring the article and those standing by it into disrepute.

I do not suggest that the Adani group has never acted in an improper manner. I do not suggest that APL is not trying to engage in a SLAPP regarding this particular article. But I would not suggest anything to the contrary unless I had sufficient proof, and I would not try to back up my argument with allegations that are misleading, whether wilfully or otherwise. When the day comes that I decide to review their dealings, I would ensure I do so with the same rigour I have used here.

Speaking truth to power is the duty of every journalist, but this objective will not be served if we don’t do it right.