Shortly after the Reserve Bank of India issued a circular permitting banks to hike ATM transaction fees, social media users shared posts voicing their disagreement with the move.

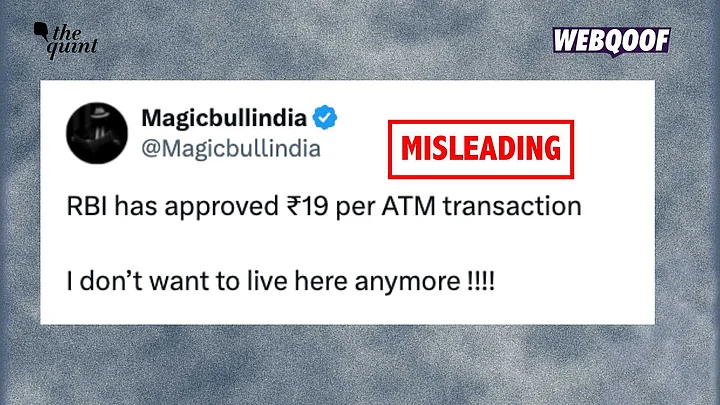

What do the posts say?: Some posts (links here, here, and here) are being shared which claim that the RBI has permitted banks to charge people ₹19 for every cash withdrawal they make from ATMs.

However, these posts lack important context and are misleading in nature.

Why?: The RBI has permitted banks to charge up to ₹21 per transaction BEYOND their permissible free transactions, which vary from bank to bank.

These charges are capped at ₹21 and ₹7 for financial and non-financial transactions respectively.

What does this mean?: If your bank allows five free monthly transactions per account, the new regulations would mean that for the sixth transaction, your bank may charge an amount of ₹23 for financial transactions, such as withdrawal or deposit of cash.

Similarly, non-financial transactions, like checking ones balance, could attract a charge of ₹7 per transaction after the account holder has exhausted their free transactions for the month.

How do we know this?: While this information is not publicly accessible on the RBI's website, government sources such as All India Radio (AIR) and Doordarshan News have published reports regarding the impending change in regulations.

AIR's report categorically stated that the hike in charges are applicable on transactions "beyond the free monthly usage by 2 rupees," taking it from ₹21 to ₹23.

"Customers are entitled to five free transactions (inclusive of financial and non-financial transactions) per month from their own bank’s Automated Teller Machines (ATMs)," the report said.

It elaborated the account holders were also eligible for free transactions if they use ATMs of banks that they do not hold accounts in. These are divided into three transactions in metro centres and five in non-metro centres.

Several news organisations, such as Economic Times, The Hindu, and Mint, among others, also carried reports with this information.

What prompted this change?: The RBI brought in this hike, which will go into action on 1 May, after white-label ATM (WLA) operators said that "rising operational expenses were affecting their business," Doordarshan News reported.

A WLA is an ATM which is run by a non-banking operator. For the consumer, using a WLA is the same as using a bank-run ATM. A list of RBI's approved list of WLAs as on 28 March 2025 can be seen here.

Conclusion: While the RBI has permitted banks to hike ATM transaction fees, they will only be applicable to transactions beyond the five free monthly transactions that account holders are eligible to avail.

(Not convinced of a post or information you came across online and want it verified? Send us the details on WhatsApp at 9540511818 , or e-mail it to us at webqoof@thequint.com and we'll fact-check it for you. You can also read all our fact-checked stories here.)