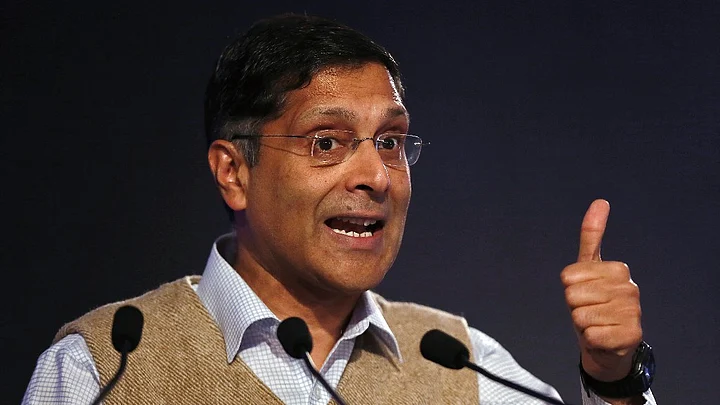

Re-igniting the debate on the politically sensitive issue of taxing agriculture income, Chief Economic Adviser (CEA) Arvind Subramanian on Friday said that states have no constitutional restriction on taxing farm incomes.

The suggestion from the CEA comes days after Finance Minister Arun Jaitley clarified that the Centre had no plans to tax farm income, but not before adding that he couldn’t since the Constitution had authorised only state governments to tax agriculture.

"The legal situation is nothing prevents state governments from taxing agricultural income. The constitutional restriction is on central government taxing agricultural income," Subramanian told reporters on the sidelines of the annual session of the Confederation of Indian Industry (CII).

There, too, one could make a case that this is a choice open to 29 state governments and if there are willing takers, all power to them.Arvind Subramanian, Chief Economic Adviser, India

The CEA also stressed the need to make a clear distinction between the rich and poor farmers.

Centre Has No Plans to Tax Farm Income: Jaitley

Earlier this week, Finance Minister Arun Jaitley said the government has no plans to impose any tax on agricultural income.

"I categorically state that the central government has no plan to impose any tax on agriculture income," Jaitley said in a tweet, clarifying that the Centre has no constitutional authority to tax agricultural income.

Talking to reporters in Delhi on Tuesday, NITI Aayog member Bibek Debroy had said that taxes should be imposed on agricultural income above a certain threshold in order to expand the tax base.

The eventual answer to expanding the tax base is to tax the rural sector, including agricultural income, above a certain threshold... While only the agricultural income of farmers is exempt from taxation, their non-agricultural income also goes un-taxed.NITI Aayog Member Bibek Debroy

"I don't believe in the artificial rural-urban distinctions. So, whatever is the threshold of personal income tax in urban areas should be for the rural areas as well," Debroy added.

The NITI Aayog, in a statement on Wednesday, said Debroy's suggestion is neither the view of the Aayog "nor is such a recommendation made anywhere in the Draft Action Agenda document as circulated to the Governing Council at the meeting on 23rd April 2017".

"NITI Aayog notes that the views on taxing farm income expressed by Member Bibek Debroy were personal and not those of the Aayog," it added.

(With inputs from IANS)