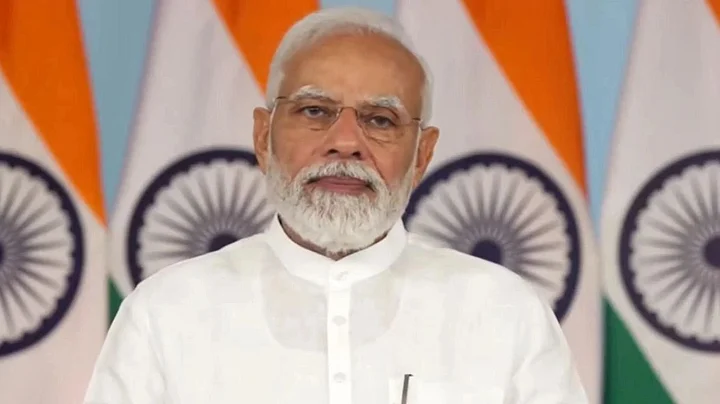

Prime Minister Narendra Modi addressed the nation on Sunday, 21 September, the eve of the implementation of the Goods and Services Tax (GST) reforms.

Finance Minister Nirmala Sitharaman on 3 September approved a two-tier structure for GST rates—5 percent and 18 percent, in addition to the 40 percent tax on sin goods (cigarettes, tobacco, aerated drinks, etc.) and luxury items.

The rate cuts will come into effect from 22 September, which coincides with the first day of Navratri, to boost consumption ahead of the festive season.

"The next-generation GST reforms, which will be implemented from midnight today, will benefit the neo-middle class, poor, farmers, and Micro, Small and Medium Enterprises (MSMEs)," PM Modi said.

'Double Bonanza' for Neo-Middle Class, Poor

Earlier this year, the PM Modi-led government had made earnings up to Rs 12 lakh per annum exempt from Income Tax.

"The rate cuts in GST, in addition to the income tax relief announced earlier this year, are a double bonanza for the neo-middle class," PM Modi asserted.

He added that the combined reductions from Income Tax and GST will result in savings exceeding Rs 2.5 lakh crore.

With the rollout of the new GST rates, the tax on certain household items including ghee, butter, condensed milk, ice cream, nuts, etc. will now reduce to 5 percent from the previous 18 percent. Meanwhile, essential kitchen staples such as milk, paneer, chapati, paratha, etc. will be free from GST.

The biggest beneficiaries of the new GST rate cuts are people planning to buy cars and other automobiles, which will now invite 18 percent GST instead of the previous 28 percent.

PM Pushes for Swadeshi Goods

Even as New Delhi grapples with US President Donald Trump's 50 percent tariffs on Indian imports, PM Modi urged citizens to buy indigenous goods, reiterating "the need to liberate ourselves from dependence" on foreign items.

He asserted that such a transformation will not only accelerate India’s development but also make the nation self-reliant. Modi also appealed state governments to boost manufacturing and create a conducive environment for investment.

WATCH: What Will Be the Impact of GST 2.0 on India's Middle Class?