A WhatsApp message has been doing the rounds which lists nine banks that the Reserve Bank of India will apparently shut down.

The message ends with a warning for readers to manage their cash immediately. This is creating a chaos, with people worrying about their accounts with these listed banks. The RBI has issued clarifications but the message accompanied by a video by “Whistleblower News India” has managed to create panic.

However, this piece of “news” turns out to be fake.

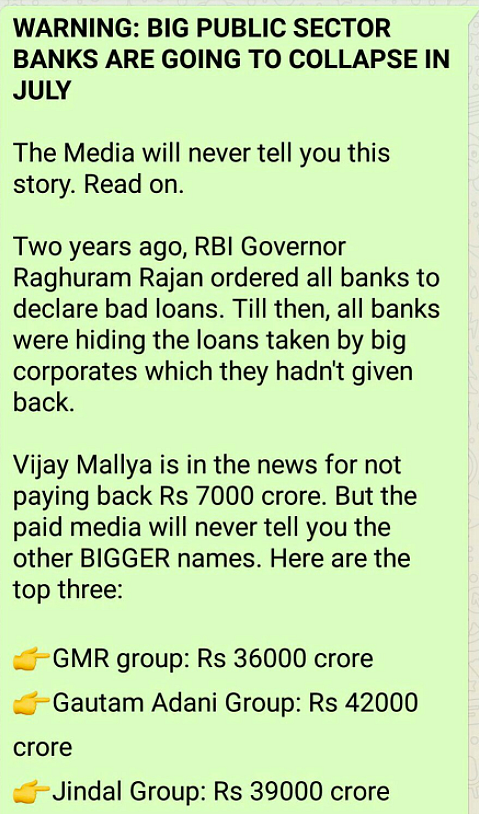

Here’s the screenshot of the WhatsApp message.

What is the Truth Behind the WhatsApp Message?

The problem of bad loans is true. As of September 2016, bad loans – or Non-Performing Assets (NPAs) – were 9 percent of total loans of all Indian banks. The NPAs of state-run banks at the end of last September rose to Rs 6.3 lakh crore, as compared to Rs 5.5 lakh crore at the end of June 2016.

In order to check this, the RBI placed certain banks under Prompt Corrective Action (PCA) which will be reviewed after three years.

The WhatsApp message lists Corporation Bank, UCO Bank, IDBI Bank, Bank of Maharashtra, Andhra Bank, Indian Overseas Bank, Central Bank of India, Dena Bank, and the United Bank of India as the banks that will be shut and asks people to withdraw their money soon.

This is however not true. The RBI in April came up with new guidelines to resolve bad loans problem and issued a new set of enabling provisions under the label of revised PCA framework.

The PCA is essentially meant to have a bank focus on their recovery of bad loans. And despite going under the PCA, there is no restriction on taking deposits or giving out loans for these banks. There is no discussion of any permanent shut down of these banks.

The RBI had also issued a clarification regarding the PCA which you can read here.

Additionally, a recent report states that a number of public sector banks are to go under a merger or consolidation with other stronger PSU Banks, similar to the recently concluded SBI associate banks’ merger. The government’s objective is to reduce the 21 PSU banks to 12.

Where the Video Gets it Wrong

In the video, host Navin Bhatia states that in the RBI’s statement on 13 April on PCA, the central bank admitted that these banks are on the verge of going under.

However, the circular says no such thing, neither did it mention any of the banks in any of its subsequent communication on PCA.

According to reports, six banks were placed under PCA – Central Bank of India, IDBI Bank, UCO Bank, Dena Bank, Bank of Maharashtra and Indian Overseas Bank. But the video incorrectly states that under PCA, banks would stop lending. This is misleading since banks under PCA are carrying out normal operations with regard to retail customers.

A report published by the ICRA in May estimated that 16 public sector banks out of 21 (excluding State Bank of India associates) would need to initiate mandatory corrective actions under the RBI’s PCA framework. But the RBI will take into consideration the number of people associated with the banks and not shut it.

There have been no reports of any bank shutting down leaving the customers hanging but Whistleblower News India’s video and the WhatsApp forwards fail to mention that.

The NPA crisis Indian banks are grappling with is real and the solution to it will be difficult but we haven’t reached a state where we have to immediately withdraw our money or lose it all.

(We all love to express ourselves, but how often do we do it in our mother tongue? Here's your chance! This Independence Day, khul ke bol with BOL – Love your Bhasha. Sing, write, perform, spew poetry – whatever you like – in your mother tongue. Send us your BOL at bol@thequint.com or WhatsApp it to 9910181818.)