As the Narendra Modi government introduces the biggest economic reform since liberalisation, we asked if the Goods and Services Tax (GST) rates would spell good news for the environment. How green are the GST rates? The findings left us confused, to say the least.

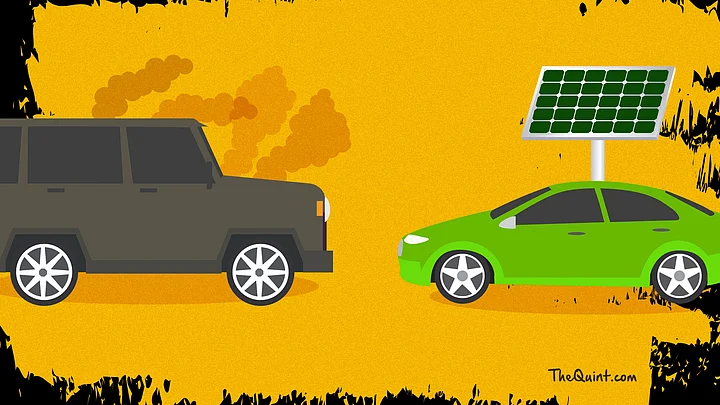

Same Tax on Fuel-Guzzling SUVs as Hybrid Cars, Why?

Under the GST rates, eco-friendly hybrid cars are clubbed with fuel-guzzling SUVs. Both now bear a 43 percent tax – GST accounts for 28 percent, while an additional 15 percent state compensation tax will be charged for a period of five years.

If you’re looking to buy SUVs, then this is good news because the vehicles are now 10 percent cheaper. However, if you’re an eco-conscious buyer, then prepare to shell out 13 percent more for a hybrid car.

Is The Govt Discouraging Indians from Going Hybrid?

India’s revenue secretary, Hasmukh Adhia clarified that small hybrid vehicles would be taxed 28 percent and large hybrids 43 percent – he didn’t specify what he meant by large hybrids.

Does this mean the automobile industry will stop investing in hybrid cars? Maruti Suzuki India Ltd Chairman, RC Bhargava, said the government had to clarify its stance, and soon.

This move of the government is almost like saying don’t buy hybrids. There will be no point in making hybrids if they are taxed as much.RC Bhargava, Chairman, Maruti Suzuki India Ltd

Toyota Vice-chairman, Shekar Viswanathan, says the industry needs time to prepare before the GST is rolled out on 1 July. “The industry needs to understand the GST policy development and its effects in a timely manner, for better planning and preparing the transitions,” Viswanathan said.

Dear Govt, Please Shed Light On The Confusing Solar Energy Tax

Solar energy generating systems are taxed 5 percent under GST. So far, so good. But here’s where it gets confusing.

Solar panels and cables are key elements of this solar energy system, and the government has taxed them separately, at 18 percent and 28 percent, respectively.

Neeraj Kuldeep, research analyst, Council for Energy, Environment and Water, pointed out how this would increase the cost of solar energy.

If panels and modules are taxed 18 percent and cables are taxed 28 percent, there will be a 11.8 percent increase in costs per unit. If the tax bracket is 5 percent, there will be a 1.6 percent increase in solar energy costs per unit.

The Quint reached out to solar energy companies and experts from the field of renewable energy for their comments. But our requests were turned down, with many claiming they were in talks with the GST council for more clarity on the rates.

Clean Energy Costs Climb

The new tax rates are bound to translate into an increase in the cost of production of clean energy.

If the 5 percent tax on solar wind and coal energy is implemented, then the costs of solar energy will go up by 1 percent. Wind energy will be costlier by 4 percent. On the other hand, the costs for coal will fall by almost 7 percent.

There will be a 1 percent increase in costs per unit for solar energy, but this is marginal in nature. The rise will be countered by more certainty in the market and in a way, there will be no impact at all.Kanika Chawla, Council on Energy, Environment and Water

The impact on wind energy, too, will be nominal, ratings agency ICRA said.

There will be close to 4 percent increase in costs per unit for wind energy. The impact of this will be marginally negative for the wind energy companies.Girish Kumar Kadam, Sector Head and Vice President, ICRA Ratings

State Compensation Tax on Coal

While costs of producing energy from coal has marginally reduced, a state compensation tax has been retained on coal which green energy has not been burdened with.

Experts say this is a continuation of the previous clean coal tax.

The amount of the tax remains the same – Rs 400. Only, now it’s called state compensation tax, which indicates a change in the purpose of levying it. From a clean coal tax now the purpose is to compensate states for revenue losses.Girish Kumar Kadam, Vice President, ICRA

Ahead of the 1 July rollout, automobile and solar industry members are meeting members of the GST council to seek clarity on the rates. But as things stand, things don’t look too green for India.