Video Editor: Vivek Gupta

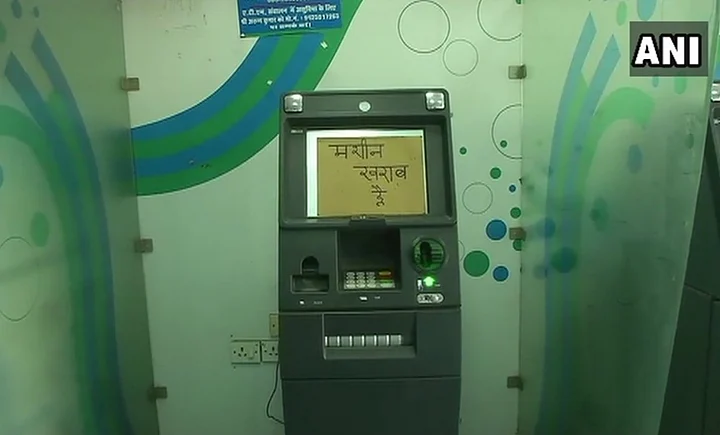

Taking after the initial weeks that succeeded demonetisation – announced by the Narendra Modi government – non-availability of cash in ATMs have been reported in several states across India including poll-bound Karnataka, Andhra Pradesh, Telangana, Uttar Pradesh, Madhya Pradesh and Maharashtra. The national capital New Delhi has reportedly been hit by the cash crunch as well.

The Reserve Bank of India issued a circular clarifying that there is no currency shortage. It said there is sufficient cash in the RBI vaults and currency chests and printing of the notes has been ramped up in all the four note presses.

The shortage may be felt in some pockets largely due to logistical issues of replenishing ATMs frequently and with the re-calibration of ATMs still underway. RBI is closely monitoring both these aspects.Reserve Bank of India

Finance Minister Arun jaitley, earlier confirming the shortage, had assured that there was adequate currency in circulation. He said that the shortage was triggered by a ‘sudden and unusual’ increase in demand.

Talking to BloombergQuint, Principal Economic Adviser Sanjeev Sanyal refused to comment on the causes for the currency shortage. He also said that there has been some evidence of hoarding as judged by the volume of currency coming back to the banking system.

Our first order of response is to make sure that adequate cash is available at ATMs and banks, so that whatever demand is there is met. Because there is no crisis and banks are in perfectly good shape. We have more than adequate cash. We will print more if it is necessary to supply. So, there is no need for anybody to panic about this.Sanjeev Sanyal, Principal Economic Adviser

Sanyal said, “We were surprised by the sudden spike in demand but we are more than in a position to supply whatever cash is necessary for whatever reason by the public at large.”

Minister of State for Finance Pratap Shukla, speaking to ANI, also confirmed the cash crunch situation, and said that it will be resolved in three days. He added that the Reserve Bank of India (RBI) has also formed a committee to transfer currency from one state to another.

We’ve cash currency of Rs 1,25,000 crore right now. There is one problem that some states have less currency and others have more. Government has formed state-wise committee. RBI also formed committee to transfer currency from one state to other.SP Shukla, Mos Finance

Rahul Gandhi Slams Govt

Slamming the government, Congress President Rahul Gandhi told ANI that Modi has destroyed the banking system.

Modi has destroyed the banking system of the country. Nirav Modi ran away with Rs 30,000 crore and PM Modi did not say a word. He made the country stand in queues. He took away Rs 500 and Rs 1,000 notes from you.Rahul Gandhi, Congress President

After Gandhi, Trinamool Congress MP Derek O’Brien also slammed the BJP government accusing them of not being able to improve the cash situation in the country even after 1.5 years of demonetisation.

This is a financial emergency. PM Modi had said that everything will be fine in 50 days, but it has now been more than 1.5 years, and there is still a cash crunch.Derek O’Brien, Trinamool Congress MP

SBI Chairman Reacts

SBI Chairman Ranjish Kumar said that the crunch was mainly due to “geographical” factors and that the situation will soon return to normalcy. He added that the RBI also intends to add more Rs 500 notes in circulation.

One reason is that procurement season has come and the payment to farmers have gone up. In Maharashtra there is no cash crunch as far as SBI is concerned.Ranjish Kumar to ANI

‘Govt Prepared to Meet Crunch in Coming Days’

The Department of Economic Affairs reacted to the cash crunch saying that the government is prepared to meet the higher demand in coming days.

The government would like to assure it would be supplying adequate currency notes to meet even higher demand in coming days/months. We are taking all steps to ensure that ATMs are supplied with cash and to get non-functional ATMs normalised at the earliest.Department of Economic Affairs

To deal with the situation, Economic Affairs Secretary S C Garg said the RBI would increase five-fold printing of Rs 500 notes to about Rs 2,500 crore a day.

"So, in a month, we will be printing about Rs 70,000-Rs 75,000 crore. This should give you assurance that we are geared up to meet the rising demand," he said.

Garg noted that there is also a perception that there may be shortage of currency in the future. So people have started withdrawing and it has contributed to the crisis, he added.

According to him, currency in stock is about Rs 2 lakh crore and these reserves are adequate to meet any unusual spurt in demand.

He assured that there was no reason for anyone to fear or any apprehension that either private sector or public sector banks are in danger. "Our banking is totally safe and people should not have in any apprehension in keeping deposits," he said.

People Fume as ATMs Go Dry

In Prime Minister Modi’s constituency Varanasi, people complained that they are unable to pay school fees and purchase groceries.

We do not know what or where the problem is, but the common man is facing difficulty as the ATM kiosks are not dispensing cash. We have visited 5-6 ATMs since morning. We need to pay for the admission of children and purchase groceries & vegetables.

In Madhya Pradesh’s Bhopal, however, citizens claim cash crunch has been prevalent for the last 15 days. “We are facing a cash crunch. ATMs are not dispensing cash. The situation has been the same since 15 days. We have visited several ATMs today as well, to no avail,” they said.

In Gujarat’s Vadodara, people complained that very few ATMs were working, and one could withdraw only Rs 10,000 from a working ATM.

People in Vadodara said that most ATMs in the city are out of service, and that they’re spending a lot of time in the queue to withdraw cash.

In Hyderabad, a person waiting to withdraw cash told ANI:

We went all around but cannot find cash in ATMs. Some shops do not accept cards and only demand cash. Modi made big promises but did not deliver them. I am very disappointed with the current government.

“We are facing cash crunch. Most of the ATMs are not dispensing cash, the ones which are dispensing, have only Rs 500 notes. We are facing difficulty, don’t know what to do,” said a citizen of Delhi, speaking to ANI.

General Secretary of Maha Gujarat Bank Employees Association (MGBEA) Janak Rawal told The Quint that “farmers, dairy producers and villagers bank with rural co-operative banks who get their cash replenishment from currency chest branches. But now that chest branches are running dry, where will the co-operative banks meet their cash requirement? This is peak season at APMC (Agricultural Produce Market Committee) markets and farmers are suffering”.

President of the Gujarat Farmers Association (Gujarat Khedut Samaj) Sagar Rabari told The Quint, “The traders are using cash crunch as an excuse to buy at low rates. Even dairy farmers are not able to get cash from their accounts and there is a 10-day pay cycle”.

Meanwhile, Gujarat’s Chief Secretary J N Singh told The Quint that the state government is in touch with the Ministry of Finance and the Reserve Bank of India and all necessary measures are being taken to normalise the cash flow.

Rs 2,000 Notes Are Vanishing, MP CM Says, Alleges Conspiracy

Madhya Pradesh Chief Minister Shivraj Singh Chouhan earlier on Monday, 16 April, claimed that Rs 2,000 notes were vanishing from the market, and alleged that there was a "conspiracy" behind it.

Addressing a farmers’ convention here, Chouhan said, “Currency worth Rs 15,00,000 crore was in circulation before demonetisation. After this exercise (demonetisation), the currency in circulation increased to Rs 16,50,000 crore.”

“But notes of Rs 2,000 are missing from the market,” Chouhan added, possibly referring to news reports of ATMs running out of cash at some places in the state.

"Where these notes of Rs 2,000 denomination are going, who are keeping them out of circulation? Who are the persons creating shortfall of cash? This is a conspiracy to create problems. The government will act tough on this," he said.

Bihar is Witnessing Cash Crunch Since 5-6 Days: State Finance Minister

Bihar Finance Minister Sushil Modi told ANI that there has been a cash crunch since the past five to six days in the state’s banks. He added, “I spoke to officials at both RBI and banks, they said that in the next few days problem will be sorted. RBI said less supply has caused a problem and it will be solved in a day or two”.

(With inputs from PTI, ANI.)

(The Quint is now on WhatsApp. To receive handpicked stories on topics you care about, subscribe to our WhatsApp services. Just go to TheQuint.com/WhatsApp and hit Send.)