The Reserve Bank of India (RBI) on Friday, 8 April, presented its first monetary policy statement of FY23, keeping the policy repo rate unchanged at 4 percent for the 11th time in a row.

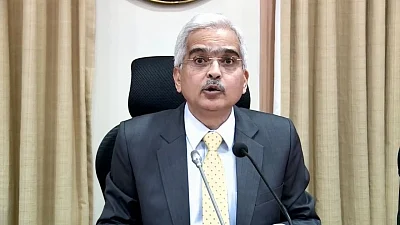

The reverse repo rate also stays unchanged at 3.35 percent, Governor Shaktikanta Das announced.

The RBI's Monetary Policy Committee (MPC) has also decided to remain accommodative in their monetary policy stance while focussing on withdrawal of accommodation to ensure that inflation remains within target going forward while supporting growth.

The marginal standing facility (MSF) rate and the bank rate also remain unchanged at 4.25 percent.

Further, the width of Liquidity Adjustment Facility will be restored to 50 basis points, the position that prevailed before the pandemic, Das stated.

Das further said that according to 2nd Advance Estimates of NSO, real GDP rose by 8.9 percent in 2021-22, showing that the Indian economy is steadily reviving from pandemic-induced contractions.

Real Gross Domestic Product (GDP) growth for 2022-23 is projected at 7.2 percent, he added.

The Pandemic & RBI's Role

While the pandemic has tested the country's resilience, the RBI has responded with bold, unconventional, and resolute measures to stabilise the economy, the RBI said.

"As the situation normalised, we have taken measures to rebalance liquidity conditions, while ensuring actions are nimble, pro-active but well-timed," Das said on Friday.

As we emerge from the pandemic, the global economy has seen tectonic shifts with commencement of war in Europe, sanctions and escalating geopolitical tensions, Das added.