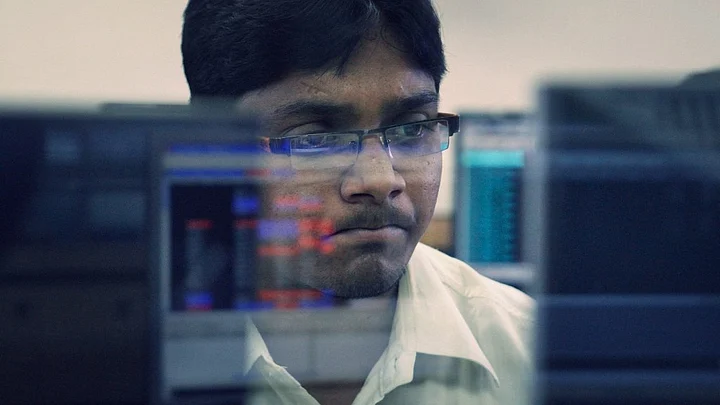

1. Sensex Falls 440 Points, Logs Longest Losing Streak Since December

Indian stocks fell for the seventh session on Wednesday, logging their biggest losing streak since December, on mounting concerns over expensive valuations and economic growth.

With an earnings recovery still not in sight, the pain in the markets may continue for a while, said analysts.

BSE’s 30-share Sensex closed 439.95 points, or 1.39 percent, lower at 31,159.81 points, its lowest close since 30 June.

The National Stock Exchange’s 50-share Nifty shed 135.75 points, or 1.38 percent, to close at 9,735.75 points, its lowest close since 11 August.

(Source: Livemint)

2. Mukesh Ambani and Sunil Mittal Warmth: Photo-op or Genuine Thaw?

They met, they greeted each other as if they were long-lost friends, they smiled for the cameras. Were these the chairmen of two companies engaged in a no-holds barred fight over the last year?

On stage together for the first India Mobile Congress, Mukesh Ambani, chairman of the Reliance Industries Ltd-owned Reliance Jio and Sunil Mittal, chairman of Bharti Airtel Ltd, temporarily dropped their adversarial stance for a rare show of camaraderie calling each other “friends” and vowing to collaborate and promote technologies such as artificial intelligence, robotics, Internet of Things, cloud computing, technologies which Ambani called “enablers of a new wave of wealth and employment for all”.

(Source: Livemint)

3. Working on Many Plans for IDFC-Shriram Deal: Piramal

IDFC and Shriram Group are working on various alternative structures to try and ensure that their proposed merger goes through, Ajay Piramal, chairman, Piramal Enterprises, said in an interview.

ET reported on Wednesday that IDFC Ltd and Shriram Capital had decided to work on a new formula to salvage the plan amid shareholder resistance and fears over dilution of holdings.

“There are many structures which were being worked upon from day one. We have said that it will depend on what RBI says and it will depend on what the valuations are,“ said Piramal, also chairman of Shriram Capital.

“So, there are many permutations and combinations which go on.”

(Source: The Economic Times)

4. Ecomm Starts Up a Lobby Group Indiatech.org

India's most valued Internet companies – Flipkart and Ola – are grouping together with peers including travel portal MakeMyTrip to launch an industry body that will represent the interests of local ventures and aim to create a moat against deep-pocketed global rivals, in one of the world's most prized markets for digital commerce.

The lobby group, Indiatech.org, led by Sachin Bansal, cofounder of Flipkart, as founding president and chairman will appoint a former IAS officer as CEO, said four people directly aware of the development. The former bureaucrat is expected to join in 2-3 weeks.

(Source: The Economic Times)

5. Time For Mint Street And North Block To Work In Tandem, Says NITI Aayog Chief Rajiv Kumar

The Reserve Bank of India and the finance ministry should work together to revive the slowing economy, said India's new NITI Aayog Vice-Chairman Rajiv Kumar.

“Any good, efficient policy meant for reviving the economy has to walk on two legs. It has to be both, monetary and fiscal,” he told BloombergQuint’s Contributing Editor Praveen Chakravarty.

“There is a time now for Mint Road and North Block to work closely together, and in tandem and figure out what is needed to be done,” he added.

Kumar said that working in sync doesn't mean an end to RBI’s independence, and instead the regulator should find ways to work in close co-ordination with the Centre.

(Source: BloombergQuint)

6. Baba Ramdev: Patanjali Needs to Borrow Rs 5,000 Crore to Support Expansion

Yoga guru-turned-businessman Baba Ramdev on Wednesday said his company Patanjali Ayurved Ltd will need to borrow Rs 5,000 crore to expand production capacity to support growth as it aims to become the largest packaged goods company in the country by March 2019.

Patanjali’s revenue will be more than HUL’s (Hindustan Unilever Ltd) in 2018-19. To support this growth, we’ll need to borrow over a period of time.Baba Ramdev

Ramdev added that his dream is to emerge as the “largest packaged goods company in the world by 2020-21”.

(Source: Livemint)

7. ONGC Set To Complete HPCL Stake Acquisition By End Of This Year

Oil and Natural Gas Corporation Ltd expects to complete the acquisition of 51.11 percent stake in Hindustan Petroleum Corporation Ltd by December end but is unlikely to pay a premium for it.

The Department of Divestment and ONGC engaged fund managers and transaction advisers to complete the deal as early as possible, ONGC Chairman DK Sarraf said at the company’s annual general meeting on Wednesday.

To fund the acquisition of HPCL shares, the company may consider selling its stake in Indian Oil Corporation Ltd. and GAIL India Ltd. or borrowing money from the market, Sarraf added.

ONGC held 13.8 percent stake in IOC and 4.9 percent in GAIL as of June 30, according to BSE data.

(Source: BloombergQuint)

8. No Cola with Ciggies? FMCG Cos are Fuming

The government's proposal to stop cigarette and paan shops from selling consumer goods such as soft drinks, biscuits and candy doesn't bode well for companies which expect a decline in sales growth if the move is implemented.

The health ministry had, on 21 September, sent letters asking state governments to develop a mechanism by which shops will need permission from municipal authorities to sell tobacco products.

The letter, which ET has seen, also asks states to prohibit such shops from selling nontobacco products such as sweets, chips, biscuits and soft drinks in a move to prevent children and those who don't use tobacco from exposure to such products.

(Source: The Economic Times)

9. Govt, RBI to Decide on Borrowing Calendar for Second Half on Thursday

The finance ministry and the Reserve bank of India (RBI) are scheduled to hold meeting on Thursday to decide about borrowing calendar for the second half of the current fiscal, officials said.

The meeting comes at a time when there are talks to relax fiscal deficit target with a view to perk up growth which has hit three-year low at 5.7 percent in April-June.

Going by the Budget announcement, the meeting will decide calendar for raising Rs 2.09 trillion during October-March period of 2017-18.

(Source: Livemint)