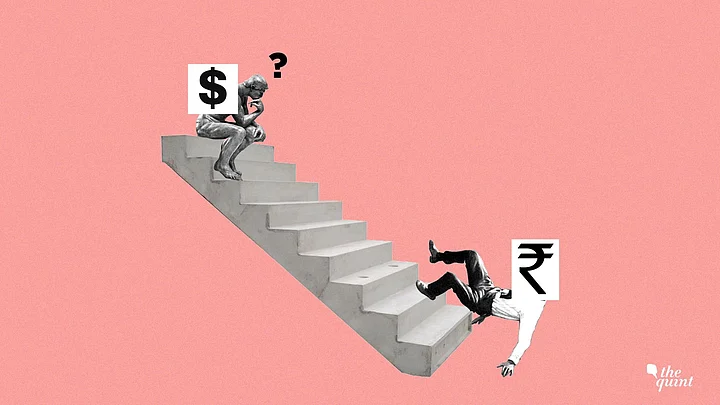

The Indian rupee has reached a record low, trading at 92.00 against the US dollar. This marks the third time in less than a week that the rupee has hit a new low. The currency depreciated by 31 paise to settle at 91.99 against the US dollar on the previous day. The decline is attributed to various factors, including foreign investment outflows and geopolitical tensions.

According to Hindustan Times, the rupee's depreciation is partly due to the drying up of overseas investment flows. The Economic Survey 2025-26 noted that the rupee weakened by about 6.5% against the US dollar from April 2025 to January 2026. This underperformance is linked to the global economic environment and domestic challenges.

As The Hindu stated in an article, the rupee's decline was exacerbated by sustained foreign fund outflows and ongoing geopolitical tensions. The currency opened higher due to a softer US dollar index but faced selling pressure from foreign funds, leading to its depreciation.

The rupee's current value does not truly reflect the strength of India's economic base, even though it is "punching below its weight," the Economic Survey highlighted.

Analysis showed that the rupee's fall is also influenced by the US's imposition of high tariffs on Indian exports. The solution to the falling rupee may lie in diplomatic efforts to resolve trade tensions with the US. The tariffs have led to capital outflows, further impacting the rupee's stability.

Coverage revealed that the rupee's depreciation has implications for India's trade balance. The country relies on foreign investment flows to maintain its balance of payments. When these inflows slow, the rupee's stability is affected, as noted in the Economic Survey. The survey also mentioned that the rupee's undervaluation could offset some impacts of higher American tariffs on Indian goods.

Following reports, the rupee's decline has raised concerns about its impact on inflation and import costs. A weaker rupee increases the cost of imports, particularly essential goods like crude oil, which accounts for a significant portion of India's imports. This could lead to higher inflation, affecting the overall economy.

The investigation continued late into the night as details emerged about the potential long-term effects of the rupee's depreciation. Experts suggest that the Reserve Bank of India may need to intervene to stabilize the currency and prevent further volatility. The situation underscores the importance of addressing both economic and diplomatic factors to support the rupee's recovery.

Note: This article is produced using AI-assisted tools and is based on publicly available information. It has been reviewed by The Quint's editorial team before publishing.