A Serendipitous Encounter With Urjit Patel…And Brutal Economic Sanctions

Chance meetings with Urjit Patel revealed sharp insights on US's sanctions playbook and global politics.

advertisement

I get serendipitous knowledge from two sources. The first are WhatsApp groups packed with a diverse mix of highly qualified and experienced people – retired IAS officers, ambassadors, academicians, corporate CEOs, doctors, lawyers, journalists, filmmakers, and what have you. This is usually a college or school group where people, having traversed different paths for over four decades, are now, near retirement, happily sharing their deep vertical insights and specialist content. I invariably stumble across podcasts, Instagram reels, YouTube videos, and article links that contain utterly original thoughts on everything, from air pollution to tennis duels to economic shenanigans to rare poetry.

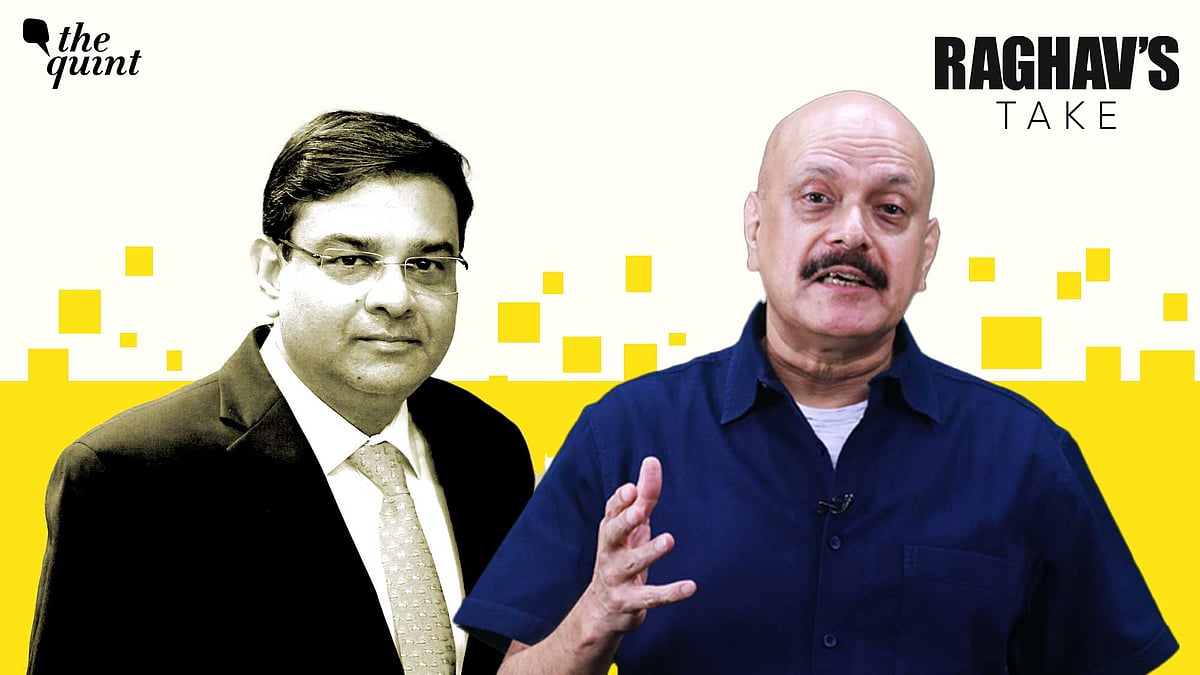

The other serendipitous spot is a first or business class seat in a top-flight airline. Often, a celebrity casually settles in the adjoining seat, and you do a furtive, yet probing, double take. Heck, is that a film star? Management guru? Politician? Television news anchor? Or Reserve Bank of India (RBI) Governor?

Dr Urjit Patel, a Fellow Traveler

A few years ago, it indeed was the RBI Governor who came and sat next to me. Dr Urjit Patel. I nodded a polite hello, not sure if a busy central banker wanted to stay immersed in files or open a conversation with a business journo. To my delight, Urjit recognised me, and broke the ice, saying how much he enjoyed my interviews and editorials. That felt good and I loosened up. What followed was 90 minutes of jaw-jaw on economics and politics. But both of us were careful about how much we let on. After all, he was handling perhaps the most sensitive economic portfolio in the country, and I was in the business of creating headlines. So, our exchange was substantive, but restrained.

Urjit is currently India’s representative on the International Monetary Fund (IMF) board, based out of Washington. Since I also passionately follow American politics, M/s Trump and Mamdani gave the perfect take-off, followed by MAGA, JD and Usha Vance, Erika Kirk, and tariffs. He regaled me with anecdotes about Ben Bernanke and Janet Yellen. I shared with him my extraordinary experience in dealing with a listed Nasdaq company which used medieval American regulations to stall our stake. We agreed that India’s stock exchanges and securities laws had evolved to a point where we could be setting the global benchmark. There were copious opinions on the state of India’s economy, and the pressing need for tax/judicial reforms.

I get awfully curious with Indians who’ve lived in China, as Urjit did during his stint at the Asian Infrastructure Investment Bank (AIIB) in Beijing. (A) because there are so few of them, and (B) because the Dragon continues to be a perennial half-masked-half-revealed mystery for people like me, who’ve read and written extensively about China but have never lived there.

The Great Sanctions Hack by All American Presidents

It’s this strand which led to the subject of sanctions. As Urjit has written in his latest book, The Great Sanctions Hack (Rupa Publications, 2025), “I joined AIIB at roughly the same time as the outbreak of the Ukraine-Russia war … there was a clear and present danger that a single country’s (ie, Russia’s) shareholding in a multilateral bank with about a hundred members could invite severe and binding secondary sanctions by Western countries – many of whom were themselves shareholders in AIIB”.

Instigated by this off-ramp apprehension, Urjit dug deep into the phenomenon of sanctions that had, almost undetected, damaged the global economy for decades.

President George Bush Jr first weaponised sanctions after the 9/11 attack on the World Trade Towers in New York. He authored Executive Order 13224 within a fortnight of the devastation, giving the Treasury sweeping powers to economically annihilate any entity that was even “suspected” of terrorist links. Bush Jr unleashed an average of 435 SDNs (Specially Designated Nationals and Blocked Persons) every year during his 2001-2008 reign.

If you think that’s excessive, see how this pernicious tactic ratcheted up under subsequent presidents - 533 per year under Barrack Obama as he expanded the spread to Russia after Crimea, Iran over its nuclear program, and Syria and Libya over human rights abuses; Trump amped it up in his first term to 1000 new secondary sanctions every year, going after Iran, Russia, China, and Venezuela; but the crowning shame here belongs to Joe Biden, who literally went nuts after the Ukraine-Russia war, sanctioning over 5000 SDNs in his four-year term.

This was economic warfare on a scale unknown to humankind. In an unintended consequence, it’s made China the “safe harbour” for sanctioned victims.

It's only fair that I end with how Urjit has framed economic sanctions as an analogy of military warfare: “Sanctions are akin to laying a slow-burning siege. Wars are waged to exact direct physical destruction; economic sanctions and associated extraterritorial instruments are, in the first place, wrought to engender direct economic harm, and eventually indirect material damage … the underlying instrumentality is the same: harm and fear”.

I will stop here. If the subject interests you, pick up the book. As for myself, I look forward to the next serendipitous encounter in business class.