No, Government Has Not Imposed GST on UPI Transactions over Rs 2,000

Finance Ministry said that these the government is not considering levying GST on UPI transactions over ₹2,000.

advertisement

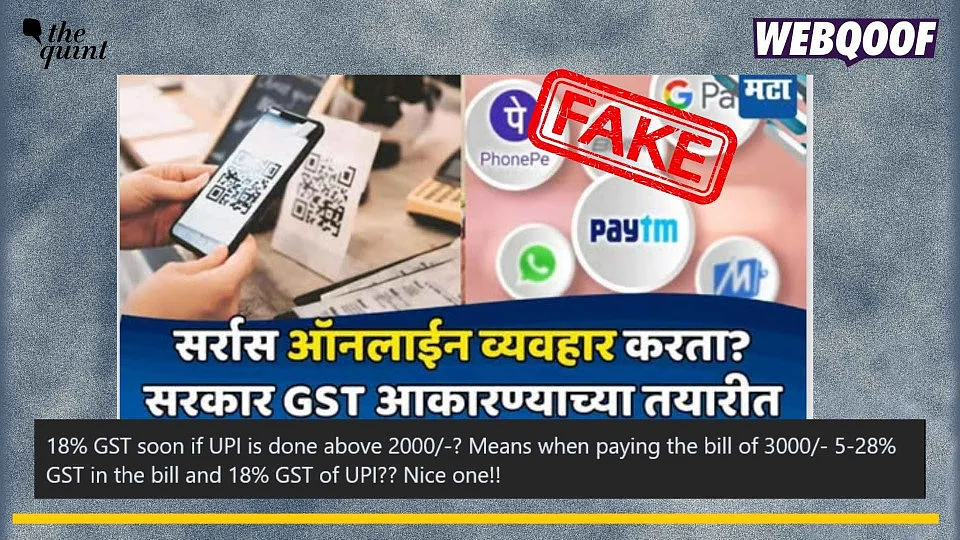

Several social media posts and Marathi news outlets like Maharashtra Times and Lokmat are claiming that the government will be levying Goods and Services Tax (GST) on UPI transactions over ₹2,000.

An archive can be seen here.

An archive can be seen here.

An archive can be seen here.

How did we find out the truth?: We performed a relevant keyword search on Google and this did not come up with any credible news report.

However, we did find a press release shared by the Ministry of Finance which clarified that this claim going viral online is false.

It said, "The claims that the Government is considering levying Goods and Services Tax (GST) on UPI transactions over ₹2,000 are completely false, misleading, and without any basis. Currently, there is no such proposal before the Government."

The notice further explained that effective January 2020, the Central Board of Direct Taxes (CBDT) removed the Merchant Discount Rate (MDR) on Person-to-Merchant (P2M) UPI transactions through the Gazette Notification dated 30 December 2019.

It further clarified that since then no MDR is charged on UPI transactions and there is consequently no GST applicable to these transactions.

The government clarified that the news was "false".

(Source: PIB/screenshot)

This was also then carried by other news websites.

Conclusion: A false claim about the government levying GST on UPI transactions over ₹2,000 is going viral online.

(Not convinced of a post or information you came across online and want it verified? Send us the details on WhatsApp at 9540511818 , or e-mail it to us at webqoof@thequint.com and we'll fact-check it for you. You can also read all our fact-checked stories here.)