QBiz: Finance Min Blames Global Factors For Rupee’s Fall & More

Govt won’t take any decision that could be misconstrued as a ‘knee-jerk’ reaction, Jaitley said, and other stories.

advertisement

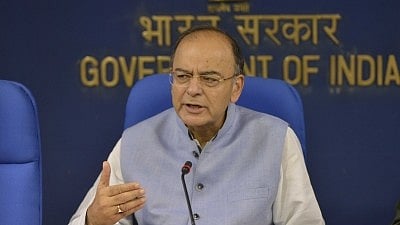

1. Global Factors Behind Rupee Fall, No Need for Knee-Jerk Reaction: Jaitley

Finance Minister Arun Jaitley said on Wednesday, 5 September, that the upheaval in oil prices and the rupee was due to global factors, and the government will not take any decision out of panic that could be misconstrued as a ‘knee-jerk’ reaction.

Jaitley was addressing a press conference – his first after his recovery from a kidney transplant surgery – after a meeting of the Union Cabinet. His comments come even as prices of petrol and diesel have reached a record high and the rupee has touched a lifetime low of 71.97 versus the dollar.

In the media briefing, Jaitley also hit back at the Congress and its President Rahul Gandhi on their allegations regarding the Rafale fighter jet deal and said the Centre will continue supporting Kerala in its post-flood rehabilitation efforts.

(Source: Business Standard)

2. US Tech Shares Tumble; Emerging Currencies Slide: Markets Wrap

Most US stocks fell, with FANG shares tumbling as executives of the tech heavyweights faced scrutiny on Capitol Hill. The selloff in emerging market assets deepened, adding to the risk-off tone on global financial markets.

Twitter, Facebook and Alphabet helped send the Nasdaq Composite Index down by 1.2 percent, the most in three weeks, during Congressional hearing on social media and foreign influences on elections. The Dow Jones Industrial Average finished in the green. The Stoxx Europe 600 Index sunk to its lowest since April. An emerging-market currency gauge fell to a fresh one-year low, led for a second day by South Africa’s rand, before paring losses.

“Trade is looking worse, emerging markets are looking worse, but you’d think FANGs are pretty insulated from some of those negatives,” said Mike Bailey, director of research at FBB Capital Partners in Bethesda, Maryland.

“Just the visual of seeing folks hauled in front of Congress is probably not helping the big-cap tech names.”

(Source: BloombergQuint)

3. Fortis Healthcare: Shivinder Singh Says Brother Malvinder Forged Wife’s Signature

Former Fortis Healthcare promoter Shivinder Mohan Singh has alleged that his elder brother Malvinder forged his wife’s signature, perpetrated illegal financial transactions and led the company into an unsustainable debt trap. In a petition filed before the New Delhi-bench of the National Company Law Tribunal (NCLT), the younger of the Singh siblings, who were synonymous with each other for decades, sued Malvinder for “oppression and mismanagement” of their companies.

The petition, which is likely to come up for hearing Thursday, 6 September, charges Malvinder, 45, and former chairman of Religare Enterprises Ltd Sunil Godhwani of putting the company in a debt trap and acting prejudicially to the interest of its creditors and shareholders. Malvinder “forged the signatures” of Aditi Singh, Shivinder’s wife, in the documents of RHC Holdings Pvt Ltd, which along with Oscar Investments Ltd jointly owned financial services firm Religare Enterprises Ltd and hospital chain Fortis Healthcare Ltd, it said.

(Source: Financial Express)

4. SEBI Says Will Review New Regulations for Foreign Portfolio Investors

Amid concerns among some FPI (foreign portfolio investor) groups, capital markets regulator Securities and Exchange Board of India (SEBI) on Wednesday, 5 September, said it will review the proposed new norms for foreign portfolio investors and take a holistic view after taking into account views of all stakeholders, including the government.

The regulator has already constituted a working group headed by former Reserve Bank of India (RBI) deputy governor H.R. Khan to look into the various issues raised by foreign portfolio investors, including those about ‘Know Your Client’ (KYC) requirements and disclosures about beneficial ownership.

In a statement, SEBI said that the working group has heard various stakeholders, held consultations and is in the process of giving its recommendations.

(Source: Livemint)

5. Anil Ambani Group’s Debt To Fall 60% After Asset Sales

It’s been a narrow escape for Anil Ambani and his group companies. A tidal wave of debt was about to overwhelm them but Ambani was able to sell a few assets just in time, ensuring the Reliance name remains creditworthy.

The younger Ambani brother’s Reliance Group is expected to lower its debt by nearly 60 percent once they complete the sale of assets. The mobile-to-metro conglomerate had a debt of more than Rs 1 lakh crore as of March and an annual interest liability of over Rs 10,000 crore, according to BloombergQuint’s calculations based on company filings. That’s expected to fall to Rs 48,645 crore after the asset sales.

Reliance Communications Ltd. is leading the group’s effort to pare debt by selling telecom towers, spectrum, real estate and DTH business. Reliance Infrastructure Ltd. recently sold its power business in Mumbai to Adani Transmission Ltd.

(Source: BloombergQuint)

6. Goldman Sachs Drops Bitcoin Trading Plans for Now: Report

Goldman Sachs Group Inc is ditching plans to open a desk for trading cryptocurrencies in the foreseeable future as the regulatory framework for crypto remains unclear, Business Insider reported on Wednesday, 5 September, citing people familiar with the matter.

In recent weeks, executives have come to the conclusion that many steps still need to be taken, most of them outside the bank’s control, before a regulated bank would be allowed to trade cryptocurrencies, the financial news website reported, citing one of the people.

The Wall Street bank was planning to clear bitcoin futures for some clients as the new contracts were going live on exchanges when the cryptocurrency rocketed to a record high of $16,000 in December.

(Source: Livemint)

7. ‘Make in India’ Boost in Schneider Electric Buying L&T’s E&A Arm

Engineering conglomerate Larsen and Toubro’s (L&T) sale of its electrical and automation (E&A) division to the French multinational Schneider Electric will spur growth in domestic manufacturing, Commerce Minister Suresh Prabhu said on Wednesday, 5 September.

A commerce ministry release said that during a meeting here with Schneider Electric Chairman Jean Pascal Tricoire, Prabhu said this project, by combining with the French company’s digital know-how, will result in greater domestic production, increased exports, reduced imports and offer a wide range of products at competitive prices.

In May, L&T signed a deal with Schneider Electric to sell its E&A business to the latter for Rs 14,000 crore ($2.1 billion).

(Source: Financial Express)

8. NDA Govt to Buy 18 Shinkansen Bullet Trains from Japan for Rs 70 billion: Report

India is planning to buy 18 bullet trains from Japan for about Rs 70 billion in a deal, which includes transfer technology for local production. "We’ll buy 18 Shinkansen train sets from Japan,” an official told Economics Times, adding that each train will have 10 coaches and would be able to cruise at the speed of 350 km per hour.

According to the report, the government will soon float a tender to procure high-speed trains in which Japanese manufacturers will participate to set up bullet trains assembly units in India in line with designs similar to that of Japan Railways.

Meanwhile, the first bullet train in India is being planned to run from Surat to Billimora in Gujarat in 2022 before the complete targetted commissioning of the 508-km corridor in 2023. The train will complete the 50-km stretch in about 15 minutes.

Modi-led NDA government wanted to run the first bullet train by August 15, 2022.

(Source: Business Standard)

9. Jan Dhan Yojana: Government Doubles Overdraft Limit to Rs 10,000

The government Wednesday, 5 September, decided to make the Pradhan Mantri Jan Dhan Yojana (PMJDY) an open-ended scheme and added more incentives to encourage people to open bank accounts.

Briefing reporters about the cabinet decision, Finance Minister Arun Jaitley said as the scheme has been a “runway success”, the government has decided to make it an open-ended scheme, meaning that it will continue indefinitely.

The PMJDY was launched in August 2014 for a period of four years as a national mission for financial inclusion to ensure access of financial services like bank accounts, insurance and pensions to the masses.

To make the scheme more attractive, the government has decided to double the overdraft facility from Rs 5,000 to Rs 10,000, the minister said.

(Source: Financial Express)