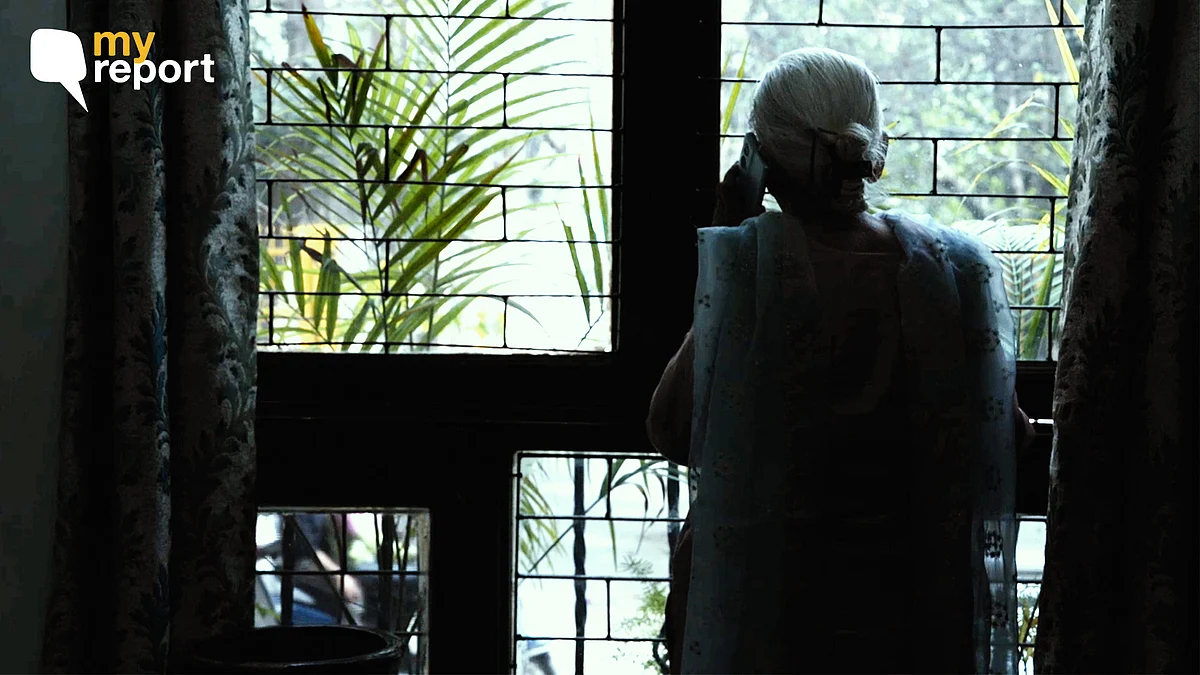

'Scammed of Rs 25 Lakh, I’m Now Dependent on My Children in Old Age'

'They sent me a fake RBI notice, claiming I needed to transfer 96% of the funds from my account for verification.'

advertisement

On 10 February 2025, I received a call on my mobile phone. The person on the other end said my mobile services were going to be disconnected. I was confused and asked him why. He claimed that my Aadhaar card had been misused in Mumbai. He even gave me his ID, and introduced himself as Vijay Sharma. He then told me that I needed to speak to Mumbai Police because my name has been linked to a money laundering case.

I am a senior citizen residing in New Delhi. My late husband's savings was my security in my old age. I was robbed off Rs 25 lakh—the bulk of that money—in a scam that unfolded over a few days through incessant texts and phone calls.

'How Can Someone Misuse My Aadhaar?'

I have no family in Mumbai, so nothing made sense to me. I was completely shaken. I asked him, “How can anyone use my Aadhaar card in Mumbai?”

The conversation soon took a terrifying turn after they told me that I had been digitally arrested—and I could face a jail sentence.

'A Fake RBI Notice'

He sent me what looked like a copy of a Reserve Bank of India (RBI) notice. It said I needed to transfer 96 percent of the funds in my account for verification purposes. I was confused, but he insisted it was a standard procedure. That amount came up to Rs 25 lakh.

When I went to the High Court branch of UCO Bank, where I hold an account, I thought the bank officials would simply check my account and confirm things.

But instead, he asked me to transfer the money.

I was so nervous that I ended up filling out the cheque incorrectly—not once, but a few times. But eventually, I filled out a cheque correctly and deposited it, transferring the money.

They had told me that my money would be returned after verification, but it never did.

My family registered a complaint on 1930 helpline number, and visited the Cyber Cell Police Station in Saket. An FIR was registered two months later, on 15 April 2025.

It’s been over three months now, but there’s still no sign of the money being recovered. All I want to say is — I relied on that money to look after myself in my old age. How long can I keep depending on my children?

(Sources at the Cyber Police Station told The Quint that the investigation is going on as per the FIR registered in the case.

The Quint also reached out to ICICI Bank regarding the case. In response, an ICICI spokesperson said that "mule accounts pose a serious challenge to society and the banking industry," adding that while such accounts are opened following standard KYC norms, they are sometimes later used—knowingly or unknowingly—for illicit transactions.

The bank clarified that the account in question had been opened in accordance with KYC regulations, including in-person verification at the company’s address. “We proactively blocked the account and reported it to the authorities after suspicious transactions were detected. Further, we are cooperating with the authorities in their ongoing investigation,” the spokesperson added.)

(All 'My Report' branded stories are submitted by citizen journalists to The Quint. Though The Quint inquires into the claims/allegations from all parties before publishing, the report and the views expressed above are the citizen journalist's own. The Quint neither endorses nor is responsible for the same.)

- Access to all paywalled content on site

- Ad-free experience across The Quint

- Early previews of our Special Projects

Published: undefined